In recent months, Indian insolvency law has witnessed pivotal rulings that continue to shape the landscape of corporate restructuring and debt resolution. The National Company Law Tribunal (NCLT) has delivered significant judgments on crucial issues, a few of them which we are discussing in this month’s Newsletter are: reconsideration of resolution plans by Adjudicating Authority, the admissibility of claims with stamping deficiencies, the scope of financial debt, and the intersection of insolvency proceedings with existing arbitration disputes. These rulings reflect the evolving interpretation of the Insolvency and Bankruptcy Code (IBC), reinforcing its primary objective of corporate revival while ensuring a fair and transparent resolution process.

From limiting the powers of the Adjudicating Authority from reconsideration of resolution plans, to addressing disputes over the classification of financial debt, these judgments provide much-needed clarity. They also highlight the delicate balance between creditor rights, debtor protection, and the efficient resolution of insolvency cases. This edition delves into recent NCLT rulings, exploring their implications for insolvency professionals, creditors, and corporate debtors alike.

-

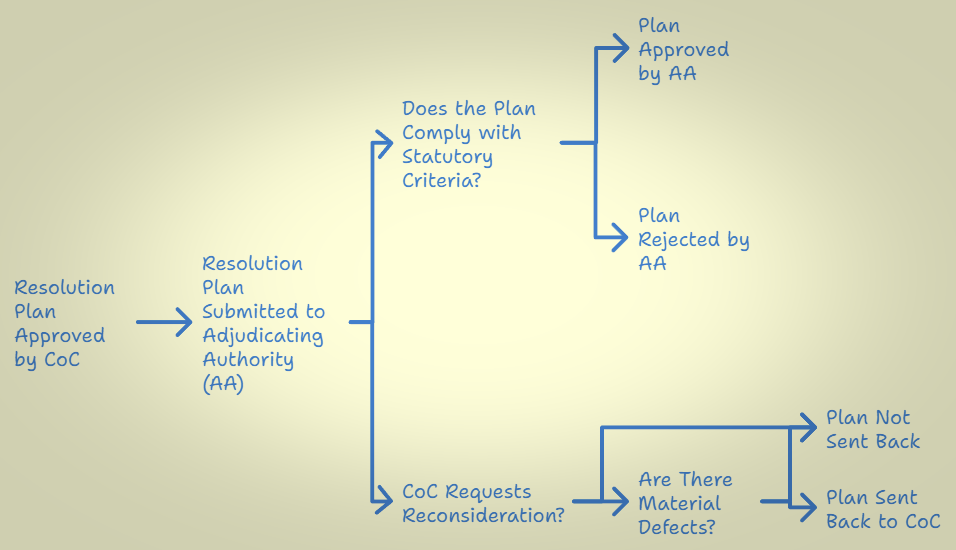

Can a Resolution Plan be sent back for reconsideration or renegotiation based solely on a request from the Committee of Creditors (CoC)?

This question has been answered by the Order pronounced on 26.07.2024 by the NCLT Punjab bench in the case of Punjab National Bank Vs Saraya Industries Ltd.IA 6058/2023 IN CP No. (IB) – 2628/(ND)/2019.

Ruling:

The Resolution Plan cannot be sent back for reconsideration/renegotiation to the Committee of Creditors (CoC) merely at the request of the CoC.

Facts:

The Adjudicating Authority (AA) admitted a company petition filed by Punjab National Bank under Section 7 of the IBC for initiating CIRP against Saraya Industries Limited. During a meeting of the CoC, a resolution plan was approved with 99.96% voting share. The Applicant then filed an application for approval of the resolution plan under Section 30(6) and 31 of the IBC, and notice was issued to all Respondents. Subsequently, a CoC meeting revealed new claims totaling Rs. 3.79 Crores, with additional claims of Rs. 14 Crores still under adjudication. PNB requested to renegotiate the resolution plan due to a significant shortfall in resolution value compared to the liquidation value. Despite the Applicant’s assertion that the IBC does not allow for reconsideration of the resolution plan, the CoC, referencing a precedent case, approved a resolution to withdraw the application for renegotiation. The withdrawal application was subsequently approved by e-voting with 87.95% share from PNB. The Applicant, acting as a facilitator, filed both the initial application and the present application for reconsideration of the resolution plan based on the CoC’s instructions.

Issue:

Whether the AA can remand the Resolution Plan back to the CoC for reconsideration/renegotiation once it has been approved and submitted by the CoC for approval of the Adjudicating Authority?

Judgment & Reasoning:

The Adjudicating Authority noted that the Applicant had acknowledged that there is no provision in the IBC allowing the AA to remand a resolution plan back to the (CoC) for reconsideration based solely on the CoC’s request. The AA’s role, as defined under Section 31 of the IBC, is limited to either approving or rejecting the resolution plan. Once a resolution plan is approved by the CoC, as in this case where it received 99.96% approval, it cannot be returned to the CoC for further consideration unless it has material defects. The NCLT referred to the decision of the Supreme Court in Greater Noida Industrial Development Authority vs Prabhjit Singh Soni [2024] 2 S.C.R. 258 : 2024 INSC 102 that outlined the grounds on which a resolution plan can be sent back by the AA to the CoC, i.e., in cases where the Resolution Plan does not follow all the parameters laid down in sub section (2) of Section 30 of the IBC, 2016 and the relevant CIRP regulations. Hence, as this particular case did not fall under the parameters laid down in Section 30(2) of IBC, 2016 the AA did not have the power to remand the Resolution Plan back to the CoC.

K S & Co Comments:

This case addressed the limits of the NCLT’s powers regarding remand of the Resolution Plan for reconsideration once they have been approved by the CoC and submitted to the Authority for its approval. The NCLT clarified that the AA’s role is confined to approving or rejecting the plan and does not extend to remanding it for further consideration based solely on the CoC’s request. The ruling emphasizes that the CoC has substantial discretion in the approval process of resolution plan, but once a plan receives the necessary majority approval, the AA must either approve or reject it based on compliance with statutory criteria. This ensures the finality and efficiency of the insolvency resolution process, preventing delays and additional negotiations post-approval. For creditors, this decision highlights the importance of thorough due diligence before voting on a resolution plan. For resolution applicants and insolvency professionals, it underscores the necessity of preparing robust and compliant plans to avoid issues during the AA’s review.

2. Revisiting the discretionary admittance of Applications under Section 7 of IBC

The Order pronounced on 16.07.2024 by the NCLT Mumbai bench in the case of Q West infrastructure Pvt. Limited vs. Starwort Engineers Private limited CP(IB)No. 229/MB/2024 and in Vineet K. Chaudhary vs NTPC Limited I.A. NO. 3453 OF 2022 IN CP (IB) NO. 1374 (MB)/2017 by the NCLT, Mumbai widened the discretionary admittance of Applications under Section 7 of IBC.

Ruling:

Deficiencies in document stamping, according to the Stamp Act, cannot be cited as grounds for rejecting an application under Section 7 of the IBC.

Facts:

Q West Infrastructure Private Limited (the Applicant/Financial Creditor), a non-banking finance company, filed a petition to initiate the CIRP against Starwort Engineers Private Limited (the Corporate Debtor). This petition, under Section 7 of the IBC, claimed a default on a principal debt of INR 17,90,73,973/- from an Inter-Corporate Deposit Agreement. The Financial Creditor lent INR 11,00,00,000/- at a 15% interest rate, with repayment due by November 10, 2021. After granting an extension, the Corporate Debtor failed to meet the revised deadline. A subsequent settlement required repayment in installments, which the Corporate Debtor also neglected. The Financial Creditor then issued a Demand cum Invocation Notice and filed a petition with the NCLT, while the Corporate Debtor contested the evidence and validity of the agreements.

Issues:

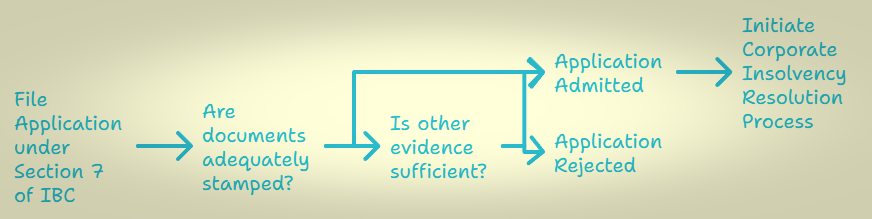

Whether an insufficiently stamped agreement between the parties prevents the admission of an application under Section 7 of the IBC?

Judgment & Reasoning:

The NCLT highlighted that the main aim of the IBC is to revive distressed companies, not just to enforce debt recovery. Referring to the Supreme Court’s ruling in Swiss Ribbons Pvt. Ltd. & Anr. Vs. Union of India & Ors. AIR (2019) 4 SCC 17, stressed that the IBC seeks to protect corporate debtors. The NCLT clarified that Section 7 proceedings focus on resolving a corporate debtor’s distress and do not require strict compliance with loan agreements to prove debt and default; alternative evidence, like bank statements, suffices. It concluded that inadequately stamped documents do not bar the application under Section 7 of the IBC. Since the application was filed within the limitation period and the Corporate Debtor required resolution, the NCLT admitted the application to initiate the CIRP.

K S & Co Comments:

The decision underscores a critical aspect of the IBC —its primary goal of facilitating the revival of distressed companies rather than focusing solely on debt recovery. The NCLT’s ruling reflects a nuanced understanding of the IBC’s purpose, emphasizing that proceedings under Section 7 are meant to address financial distress and not merely act as debt recovery mechanisms. By referring to the Supreme Court’s judgment in Swiss Ribbons Pvt. Ltd. & Anr. Vs. Union of India & Ors, the NCLT reaffirmed that the IBC is designed to protect and rehabilitate corporate debtors. This judgment highlights that while the adequacy of stamping on documents is important under the Stamp Act, it should not impede the initiation of insolvency proceedings if other evidence, such as bank statements and financial records, sufficiently establishes the existence of debt and default. The NCLT’s decision to admit the application despite the stamping deficiencies demonstrates a practical approach, ensuring that the IBC serves its intended purpose of corporate revival and resolution rather than being obstructed by procedural technicalities.

Vineet K. Chaudhary vs NTPC Limited I.A. NO. 3453 OF 2022 IN CP (IB) NO. 1374 (MB)/2017

Ruling:

The National Company Law Tribunal, Mumbai Bench, held that provisions of section 60(5) of IBC 2016, can be invoked for recovery of admitted dues payable to the Corporate Debtor instead of Civil Court(s) or arbitral Proceedings to achieve the objects of the Code.

Facts:

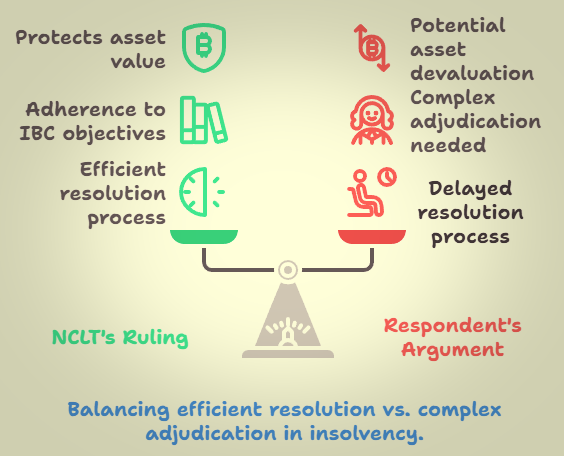

NTPC Limited (Respondent) issued two work orders to Petron Engineering Construction Limited (Corporate Debtor), which were completed by July 2020. However, the Respondent withheld Rs. 22,72,62,756/- in dues, acknowledging only Rs. 12,34,01,237/- payable during account reconciliation. They refused to release the payment, demanding a No-Demand Certificate. As per the contract, 10% of each RA Bill was retained. After the NCLT initiated CIRP against the Corporate Debtor, leading to liquidation, the Respondent still failed to clear the bills. Despite the Corporate Debtor’s requests for certification of bills and a completion certificate, the Respondent remained unresponsive. Instead, they imposed liquidated damages of Rs. 5,74,64,442/- and encashed bank guarantees worth Rs. 14,69,53,711/-. They later admitted dues of Rs. 12,34,01,237/- but still demanded the No-Demand Certificate. The Respondent’s actions delayed liquidation, prompting the Corporate Debtor to approach the NCLT. In defense, the Respondent argued that the Liquidator should have sought legal remedies first and claimed that the issue required complex adjudication beyond the Tribunal’s jurisdiction.

Issues:

Whether Section 60(5) of the IBC 2016 can be invoked to recover admitted dues in relation to the services rendered by the Corporate Debtor, rather than resorting to Civil Courts or arbitration, in order to fulfill the objectives of the Code?

Judgment & Reasoning:

The NCLT observed that the Respondent had acknowledged its obligation to pay INR 12,36,28,455/- in an email. The bench referred to the Supreme Court’s decision in Gujarat Urja Vikas Nigam Ltd v/s. Amit Gupta AIR 2021 SC 123 , which emphasized that the IBC is designed to streamline insolvency proceedings under a unified jurisdiction to expedite resolutions. The bench noted that Section 60(5) of the IBC, with its non-obstante clause, provides the NCLT with exclusive jurisdiction over insolvency matters, preventing other forums from handling such cases. The NCLT highlighted that the insolvency and liquidation process under the IBC is meant to be time-bound, as delays could reduce asset value and undermine the Code’s objectives. It ruled that requiring the Applicant to pursue recovery through civil courts or arbitration for admitted dues would counteract the aim of a prompt resolution. The bench also noted that the Corporate Debtor continued to provide services during the CIRP, and the Liquidator’s efforts to recover dues for these services were directly related to the insolvency process. For dues exceeding the admitted amount, the NCLT indicated that the Liquidator could seek authorization under Section 33(5) of the Code to initiate appropriate legal action. As a result, admitted amount of INR 12,36,28,455/- to the Applicant.

K S & Co Comments:

The NCLT’s ruling reinforces the core principle of the IBC which is to ensure efficient and unified resolution of insolvency cases. By affirming that admitted dues should be resolved within the IBC framework rather than through separate civil or arbitration processes, the tribunal upholds the Code’s intent to expedite the resolution process and protect asset value. The decision also underscores the importance of adhering to the IBC’s structured process and prevents delays that could otherwise undermine the effectiveness of insolvency proceedings.

-

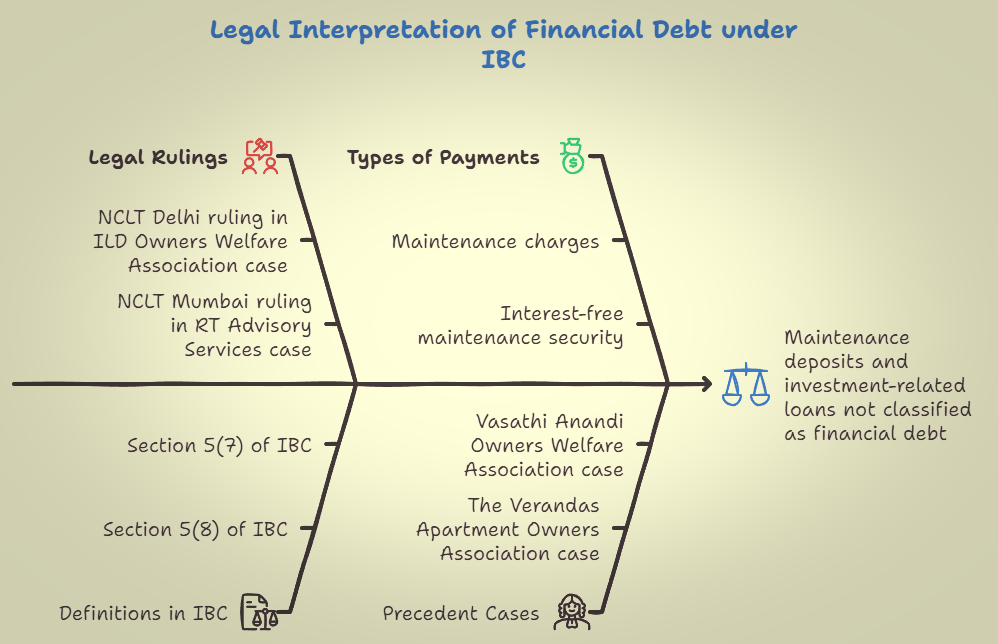

Do the definitions of financial debt in the Insolvency and Bankruptcy Code encompass maintenance deposits and investment-related loans?

The definitions of financial debt under the IBC do not encompass certain types of payments and loans, such as maintenance deposits and investment-related loans, which was clarified through the below legal rulings decided by NCLT, New Delhi bench in the case ILD Owners Welfare Association vs M/s. ALM Infotech City Private Limited on 30.07.2024 and NCLT Mumbai Bench in the case RT Advisory Services LLP vs Sardesai Engineering Private Limited on 19.07.2024.

ILD Owners Welfare Association vs M/s. ALM Infotech City Private Limited C.P.(IB)–229(ND)/2024

Ruling: Maintenance charges and interest free maintenance security (IFMS) paid by the Applicants to the Corporate Debtor do not qualify as financial debts within the meaning of section 5(8) of the IBC 2016.

Facts:

The Respondent/Corporate Debtor is the developer of the project in question and collected Rs. 2.95 crores as an interest-free maintenance deposit from the residents of the Complex. According to the Conveyance Deed, this amount was to be handed over to the Applicant/Financial Creditor (Residents’ Welfare Association). Despite numerous requests, the Corporate Debtor has failed to transfer the funds to the Applicant/Financial Creditor. As a result, the ILD Owners Welfare Association, a registered Resident’s Welfare Association representing the owners and residents of “ILD Trade Centre” (the Society/Financial Creditor), has filed a joint application with the President of the Society. This application, submitted to the Adjudicating Authority under Section 7 of the IBC, seeks an order to initiate the CIRP against ALM Infotech City Pvt. Ltd., the Corporate Debtor.

Issues:

Whether maintenance charges and interest free maintenance security (IFMS) will fall under the ambit of the definition of financial debt within the meaning of section 5(8) of the IBC 2016?

Judgment & Reasoning:

The Adjudicating Authority relied upon the order passed by NCLT Delhi in the Verandas Apartment Owners Association Vs. Saluja Construction Company Ltd. (2023), where it was determined that such amounts do not constitute financial debt. The Counsel for the Applicant pointed out that the stated order is currently under appeal before the Hon’ble NCLAT. The Adjudicating Authority observed that the Hon’ble NCLAT issued a notice to the Respondent and directed the completion of pleadings, but no interim stay on the order has been granted. Consequently, the order remains in effect and applies to the present case. The Adjudicating Authority also relied upon the decision of the NCLT Hyderabad Bench, in Vasathi Anandi Owners Welfare Association v. Vasathi Housing Limited (2023), that an application involving such facts is not maintainable and that the Applicant does not qualify as a Financial Creditor under Section 5(7) of the IBC. In line with the view taken by the Hyderabad Bench, the Adjudicating Authority agreed that the amounts for maintenance and IFMS do not constitute financial debt as defined under Section 5(8) of the IBC. Therefore, the application filed under Section 7 of the IBC is not maintainable.

K S & Co Comments:

The judgment reaffirms that maintenance charges and interest-free maintenance security do not qualify as financial debt under Section 5(8) of the IBC. This ruling is consistent with recent legal precedents, which confirm that amounts collected for maintenance and security deposits, although potentially substantial, do not meet the criteria of financial debt required for initiating the CIRP. The decision draws on established rulings from both the Delhi and Hyderabad Benches, highlighting a uniform interpretation of the IBC in such cases.

RT Advisory Services LLP vs Sardesai Engineering Private Limited CP (IB) No.634/MB/2023

Ruling: The Memorandum of Understanding (MOU) and Loan Agreement related to the acquisition and development of land are investments rather than financial debt under the IBC.

Facts: RT Advisory Services LLP (Petitioner/Financial Creditor) claimed Rs. 5.19 crore from Sardesai Engineering Pvt. Ltd. (Corporate Debtor), consisting of Rs. 4.69 crore in principal and Rs. 50.37 lakh in interest. The parties had signed an MOU for transferring the Corporate Debtor’s entire shareholding to the Financial Creditor, followed by a Loan Agreement allowing the Corporate Debtor to borrow up to Rs. 7.5 crore at a 12% interest rate, with the option to convert the loan into equity. Out of Rs. 10.26 crore disbursed, Rs. 5.56 crore was repaid. Disputes arose over share transfers, and the Corporate Debtor denied the Loan Agreement’s existence. After issuing a Demand Notice, the Petitioner filed a Section 7 petition under the IBC with the NCLT.

Issues: Whether the MOU and Loan Agreement intended for the acquisition and development of land constitute a financial debt under the IBC?

Judgment & Reasoning: The NCLT observed that the Loan Agreement between RT Advisory Services LLP and Sardesai Engineering Pvt. Ltd. involved funds raised for land development owned by the Corporate Debtor. This was part of a broader strategy under the MOU to transfer control of the Corporate Debtor through share purchases. The Corporate Debtor argued that the Loan Agreement was created by Petitioner-appointed directors after the MOU. The funds were primarily intended for land development, with the Loan Agreement structured as an investment, not a financial debt. Despite the MOU’s plan to transfer shares to the Financial Creditor, disputes led to a Settlement Agreement, returning the shares to the Corporate Debtor. The court ruled that the transaction was an investment rather than financial debt under the IBC.

K.S & Co. Comments:

The NCLT’s ruling provides clarification on the distinction between financial debt and investment under the IBC. The NCLT found that the MOU and Loan Agreement in question were fundamentally investment transactions and not financial debts. This ruling underscores the importance of distinguishing between strategic investments and financial debts in insolvency proceedings. The decision highlights the need to carefully assess the nature of financial arrangements to determine their eligibility under Section 7 of the IBC, as investments intended for asset development may not qualify as financial debts subject to insolvency resolution. The NCLT reiterated that the aim of IBC is to resolve insolvency and not to assist in recovering debts.

Both cases highlight that the nature and intent of the transaction play a critical role in determining whether it falls within the definition of financial debt under the IBC.