Delhi High Court | Copenhagen Hospitality and Retail v. A.R. Impex

In recent matter of Copenhagen Hospitality and Retail v. A.R. Impex it is held that a prima facie view on territorial jurisdiction must be based on the averments made in the plaint and the documents relied on by the plaintiff, and if same brings out the ingredients for establishing the court’s jurisdiction, that would be sufficient for the court to assume jurisdiction.

Background:

- In the present case, Copenhagen Hospitality and Retail, the Plaintiff is the Franchise Holder of “LA PINO’Z PIZZA,” which has several franchised outlets throughout India. The plaintiff and the defendant R. Impex agreed upon that defendant will manage and operate the LA PINO’Z PIZZA in the city of Ahmedabad as a sub-franchise, including their social media handles.

- In one of the franchises outlets in Ahmedabad, they removed Plaintiff’s franchise name and hoardings and replaced it with “LA MILANO PIZZERIA,” which had the same logo as Plaintiff’s Franchise and owned by defendant A.R Impex. Since the defendants have violated the master franchise agreement, which was executed between the parties to operate and manage the “LA PINO’Z PIZZA” franchise and sub-franchise in Gujarat, the IP rights of the Plaintiff is at stake. Upon conducting an investigation, Plaintiff found that Defendant was breaching their trademark rights and filed a suit before the Hon’ble High Court of Delhi.

- The contention raised by Defendants who had both registered office and place of effective business in Ahmedabad. They claimed that violation of the impugned rights as well as alleged confusion was also caused in this market nor could the infringing article be purchased online within the said jurisdiction of Delhi, where Plaintiffs deliberately chose to file the present proceedings to cause hardship and inconvenience to Defendant No.1. On the other hand the Plaintiff submitted that the defendants had been contacting the parties at Delhi for establishing their franchisees, including plaintiffs’ Master Franchisee in Delhi. Therefore, the cause of action arose in Delhi. Further, he added that in case the defendants do not intend to expand their operation in Delhi, they should make a statement to that effect.

Court Held:

The Court stated that Defendant is infringing the Plaintiff’s trademark and the goodwill associated with the mark using it for his benefit. The Court also restrained the Defendants from infringing the Plaintiff’s registered mark and using the Plaintiff’s social media accounts for unfair advantage. The Court concluded that the plaintiff has made out a prima facie case and stated that there is no ground that Plaintiffs’ allegations are mis-founded or could be construed as false. Further, the defendants were restrained from using the plaintiff’s registered trademark in any manner whatsoever.

Considering the nature of business, the prior relationship of the parties, and the business format of establishing franchisees, it cannot be assumed that the Plaintiffs’ allegations are mis-founded and since, the occurrence of the cause of action paved way for jurisdiction, which was the determinative factor u/s 20 of the CPC, clearly vests in this Court and defendant would have to prove their contentions during the trial.

K S& Co. Comments:

Intellectual property rights act as a tool against any breach of intellectual properties and brand values attached to the franchise for the Franchise holder. Franchise holders often execute franchise agreements to engage with different outlets in different areas to expand their franchise. In any circumstance, if the franchise outlets owner violates the terms and conditions of the franchise agreement, the franchise holder can claim relief for the same. Here, in cases like this, IPR plays an essential role in safeguarding the interests of the Franchisor.

Bench held that the question of territorial jurisdiction in matters relating to infringement of trademarks is well-settled by precedents of Sanjay Dalia Case [(2015) 10 SCC 161] & Ultra Homes Case [(2015) 222 DLT 205: (2015) 64 PTC 119] where they expanded the horizons of jurisdiction so as to include claim of accessibility of social media and that the infringing article can be purchased with such online presence. Further, section 134(2) of TM act and section 62(2) of copyright act are in addition to section 20 of CPC and hence the occurrence of cause of action was the determinative factor u/s 20.

Can payment made for purchase of computer software be termed as ‘Royalty’?

Supreme Court | Engineering Analysis Centre of Excellence Pvt. Ltd. Vs. Commissioner of Income Tax

Background

Two sets of appeals were heard by the Supreme Court, one from the High Court of Karnataka and the other from the judgments of the High Court of Delhi. The contradictory rulings on the issue by the Authority for Advance Rulings (AAR) were also set to rest by the Supreme Court.

The appellant Engineering Analysis Centre of Excellence Pvt. Ltd., in this case, was an Indian Company who sells shrink-wrapped computer software that was imported straight from a non-resident corporation. As the transactions comprised a sale of goods, the appellant did not deduct tax on the payments made to the non-resident entity. But on the other hand, the claim of the Department of Revenue, Ministry of Finance (Revenue) was that the transaction between the parties was a copyright for the right to use the software, which resulted in royalty payments, and consequently assessed that tax should be deducted at source under Section 195 of the Act.

When the matter was brought before the High Court of Karnataka by various assessees, the High Court upheld the appeal, citing its decision in CIT v. Samsung Electronics Co. Ltd. & Others (2012) which held that what was sold as computer software included a right or interest in copyright, resulting in the payment of royalty and being deemed to be an income of the resident in India under Section 9(1)(vi) of the Act, requiring the deduction of tax at source.

The appellant, along with other assessees, filed civil appeals with the Supreme Court after being aggrieved by the decision of the court.

The Supreme Court divided the appeals into the four kinds of software payments listed below:

Category 1: A non-resident selling software straight to an end-user. Category 2: Non-residents selling software to Indian distributors for resale to Indian end-users. Category 3: Sale of software to a foreign distributor for resale to end customers in India by a non-resident. Category 4: Software that is bundled with hardware and distributed to Indian distributors or end-users by foreign providers.

Court Held

The Supreme Court, in a detailed judgment, held that:

Upon application of the DTAA, provisions of the Act can only be applied to the extent they are more beneficial to the assessee. Tax Deduction at Source under Section 195 of the Act can only be made if a nonresident is liable to pay tax under the charging provision in Section 9 read with Section 4 of the Act and the DTAA. The judgment of PILCOM would not be applicable to the present case.

As per amended Sections 14(b)(ii) and 52(1)(aa), making of copies or adaptation of a computer programme in order to utilise the said computer programme for the purpose for which it was supplied, or make back-up copies does not constitute infringement of Copyright and does not amount to parting with copyright. The EULAs have to be read as a whole to ascertain the true nature of a transaction. What is licensed is sale of a physical object which contains an embedded computer programme and is, therefore, sale of goods as per Tata Consulting. Explanation 4 to Section 9(1)(vi) of the Act cannot have retrospective application. Hence, in all the four categories, the Supreme Court held in favour of the assessees.

K S& Co. Comments:

This Apex Court judgment has progressively settled and resolved conflicting views taken by the High Court of Karnataka and Delhi and the AARs, in the controversy surrounding the taxation of payments for computer software in international transactions which had been a subject matter of extensive litigation for over two decades. The judgment is a welcome move and a positive step that will have a wide-ranging influence on software businesses doing business in India.

We’re all in this together; partners by Estoppel

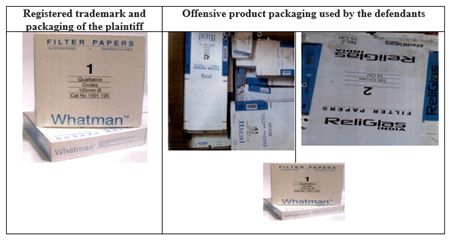

Whatman International Limited v/s P Mehta &Ors.

Background:

The plaintiff co., founded in 1740, is involved in manufacture & sale of various products, including filter paper, having trademark WHATMAN registered in India, consisting of a distinctive white background with a blue script. Plaintiff filed a suit seeking permanent injunction and punitive damages against the defendants who sold filter papers under the trademarks- ‘HIRAL,’ ‘ACHME,’ ‘LABSMAN,” UCHEM’ and ‘SUN.’ for allegedly infringing the plaintiff’s rights by using a similar color combination for selling their filter papers.

Plaintiff contended citing instances of sheer contempt of court orders and undertakings given by the defendants even before this case. Further, during the 4 visits by Local Commissioners to registered places of the defendants, they seized various packages bearing the plaintiff’s trademarks and other above-mentioned impugned marks.

The defendant claimed running independent businesses not connected to the plaintiff, yet their testimonies and presence during the law commissioners’ visits at each other’s premises validated the plaintiff’s claims. Under these findings and evidence, along with a series of heated arguments and blatant denials, the plaintiff pleaded for permanent injunction and punitive damages against the defendants.

Court Held:

Defendant nos. 1 to 5 and defendant no. 7 were held guilty of contempt.

The plaintiff was awarded the following to be paid by the following defendants within a period of three months from the date of pronouncement of the judegment damages worth rupees 1 crore as against 3 defendants, damages worth Rs. 25 lakhs as against 3 defendants and damages worth Rs. 10 lakhs as against one defendant. Along with this, permanent injunction was also passed against all the defendants.

K S& Co. Comments:

The Delhi High Court has established by this judgement that courts must exercise extreme caution when awarding exemplary punitive damages in cases of libel and tortuous claims involving financial and intellectual property matters, and that the circumstances and rule of caution laid down in Brookes and Cassel and further confirmed by the Hon’ble Supreme Court in Hindustan Unilever (supra) is the rule of law and of paramount importance when adjudicating such claims.

Revisiting settled tenets of Indian copyright law

Allahabad High Court’s refusal to stay release of the film ‘Chehre’| Uday Prakash v. Anand Pandit and Anr’

Background:

The plaintiff-appellant, Uday Prakash, instituted a suit before the District Judge, Ghaziabad, claiming copyright infringement of his literary work titled ‘Highway-39’ which was registered as copyright in 2007. The plaintiff claimed to have discussed his copyrighted work with an acquaintance, Mr. Mazhar Kamran (cameraman). The plaintiff alleged that, in June 2019, that he became aware through a “reliable source” that Mr. Anand Pandit (Defendant-Respondent no. 1) was producing a movie titled ‘Chehre’ that was based exactly on the same ‘plot and premise’ as the plaintiff’s work. Rumi Jaffery, the director of the said impugned work, is the second defendant-respondent in the present case.

The defendant contented that the suit was based upon hearsay arguments and that even the details of the ‘reliable source’ who mentioned about the script being same, was not being disclosed by the plaintiff nor did he have any other way to find the similarity and apprehend injury before the movie was released. In furtherance they approached the court at last moment before its release.

Court Held:

The Court stated that there prima facie case should be established for the case of infringement and went on to analyze the facts laid in support of evidence as:

- A mere discussion of a work involving intellectual intricacies with another person is not enough to impute that this other person would share it with a third party. As here, discussion with cameraman solely cannot be asserted to link that this cameraman was handed over the contents or that he palmed it off to defendants.

- The plaintiff did not name the ‘reliable source’ who informed about the copyrighted work being plagiarized which in turn creates hindrance to make for a prima facie case for infringement of copyright.

- Further, the plaintiff never had the chance to see what the contents of the script leading to the feature film were, as the movie had not been released yet. The plaintiff inferred it to be a copy of his work based on some hearsay vague allegations and thus, the entire action is based on the plaintiff’s conjecture. This cannot be the basis of an action for infringement of copyright.

The court laid reliance upon the principles of giving injunction on basis of irreparable loss and balance of convenience but stated that here; there was no direct link to affirm any of the contentions held any value and more over that the commonalty of themes do not cause infringement. And finally, the plaintiff though had knowledge even before but waited till 11th hour before the release date to ask for injunction and hence, the Court found no reason to grant the same.

K S & Co. Comments:

Though it may be noted that the scripts were based on similar themes but the law is clear that commonality will not defeat it and in furtherance it can be seen that the plaintiff was being secretive by not disclosing the details of reliable source to the court and had weakened its own case and even further they approached the court at 11th hour for which the court had time and again stated that plaintiff who approached the court at 11th hour as delay for such equitable relief is always fatal which was even highlighted in 2021 case of John Hart Vs. Mukul Deora.

Eliminates the Dilemma between Trademark Infringement and Passing Off

Calcutta High Court| Biswanath Hosiery Mills Limited &Anr. v. Micky Metals Limited

The All India Film Chamber of Commerce (AIFCC) has applied to be registered as a copyright society under Section 33 of the Copyright Act, 1957, for the purpose of issuing or granting licenses in respect of creative works, which include literary, dramatic, musical, and artistic works incorporated in cinematograph films or sound recordings. The Copyright office notified the same with a public notice.

K S & Co Comments

In India a copyright society is registered under Section 33 of the Copyright Act, 1957. Such societies are formed by authors and owners and only one society can be registered to do business in respect of the same class of works.

However, in recent years, the government has convened a number of stakeholder workshops to explore the many elements of registering several copyright societies as opposed to a single copyright society in a single class of work. On this subject, the industry is divided. Those in favour of multiple societies for same class of work are of the view that competition is necessary and users should have choice of multiple societies to avoid monopolistic practices being carried by a single society. Regional actors, in particular, have advocated for the establishment of different organizations for the same type of activity. The government will very certainly receive multiple objections to AIFCC’s registration as a copyright organization. It remains to be seen whether the government is convinced of the need for a single copyright organization dealing with all underlying works, with a special focus on the South Indian regional cinema and music industries.