Trademark Squatting in India’s Tier 2 Cities: The New IP Battleground—And the Global Lessons Behind It

Discover how trademark squatting is becoming a strategic weapon in India’s tier‑2 cities. From Apple’s $60M iPad dispute to Burger King’s Pune controversy, learn why early trademark filings matter more than ever — and how businesses can protect their brand names before expansion.

Third Party Funding in the Indian Arbitration Scenario

Third-Party Funding (TPF) is transforming access to justice in India, especially in arbitration. This article explores the evolution of TPF, its judicial recognition, and regulatory challenges. Highlighting key case laws, ethical considerations, and international perspectives, it emphasizes the need for a balanced regulatory framework to ensure fairness, transparency, and protection for all stakeholders. Discover how India can harness TPF while aligning with global best practices.

Maharashtra’s New Stamp Duty Ordinance 2024: A Game Changer for Arbitration

Introduction: Understanding Stamp Duty in the Context of Arbitration The Honorable Supreme Court of India on 13th December, 2023 in Re, Interplay Between Arbitration Agreements Under the Arbitration and Conciliation Act of 1996 and the Indian Stamp Act of 1899 overturning the prior judgment in NN Global Mercantile Private Limited v. Indo Unique Flame Limited addressed […]

INDIAN PERSPECTIVE ON DETENTION AND DEMURRAGE

A shipping transaction is a commercial contract among the shipper (exporter), carrier, and consignee (importer) to facilitate the cross-border sale and transfer of goods via international waters. When an exporter or owner of goods intends to transport those goods by sea, the carrier, typically a shipping line, issues a Bill of Lading (BOL) to the […]

Local public policy exceptions in India to the enforcement of international conventions or treaties

Explore the complexities of enforcing international conventions in India with a focus on public policy exceptions in arbitration. This article, authored by Krrishan Singhania, delves into India’s legal landscape, highlighting key cases and the impact on international treaties and maritime law.

Understanding Indian Laws protecting Personality Rights

Explore the intricacies of personality rights in India, including legal frameworks, key cases, and practical measures to protect personal identity and reputation from unauthorized commercial use and defamation.

The interplay between the Cape Town Convention and insolvency law when a private airline company undergoes liquidation in India

This article provides a detailed analysis of how the Cape Town Convention (CTC) intersects with India’s Insolvency and Bankruptcy Code (IBC) in the context of aviation insolvency proceedings. Specifically, it highlights a case where a private Indian airline, Go First, voluntarily entered insolvency due to issues with aircraft engine suppliers. The article discusses the legal challenges and processes involved, including moratorium exceptions, creditor negotiations, and asset recovery by lessors. It underscores the Indian government’s efforts to align domestic insolvency laws with international conventions to protect the interests of aircraft lessors, thus fostering a more secure environment for international leasing activities in the Indian aviation market.

Liability of Ships and Ship Owners for the Bunker Supply Debts of Time Charterers

The article delves into the evolving legal landscape, including the impact of the Admiralty (Jurisdiction and Settlement of Maritime Claims) Act, 2017, and key court decisions shaping current jurisprudence.

This article aims to shed light on:

• The concept of maritime claims and ship arrests.

• The legal responsibilities surrounding bunker supplies under charterparties.

• Notable court cases and their implications for shipowners and maritime claimants.

Delhi Metro Rail Corporation Ltd. v. Delhi Airport Metro Express Pvt Ltd.

In the landmark case of Delhi Metro Rail Corporation Ltd. v. Delhi Airport Metro Express Pvt. Ltd., the Supreme Court of India, on April 10, 2024, set aside an INR 8000 Crore arbitral award using its curative jurisdiction. This judgment revolved around a 2008 Concession Agreement and highlighted the boundaries of judicial review in arbitration.

The Supreme Court found the arbitral award patently illegal due to the unreasonable interpretation of the termination clause, neglect of vital evidence, and insufficient reasoning. This ruling underscores the need for careful balance in arbitration, ensuring justice while limiting judicial interference. Such measures are crucial for India’s ambition to be a global arbitration hub and an attractive destination for foreign investment.

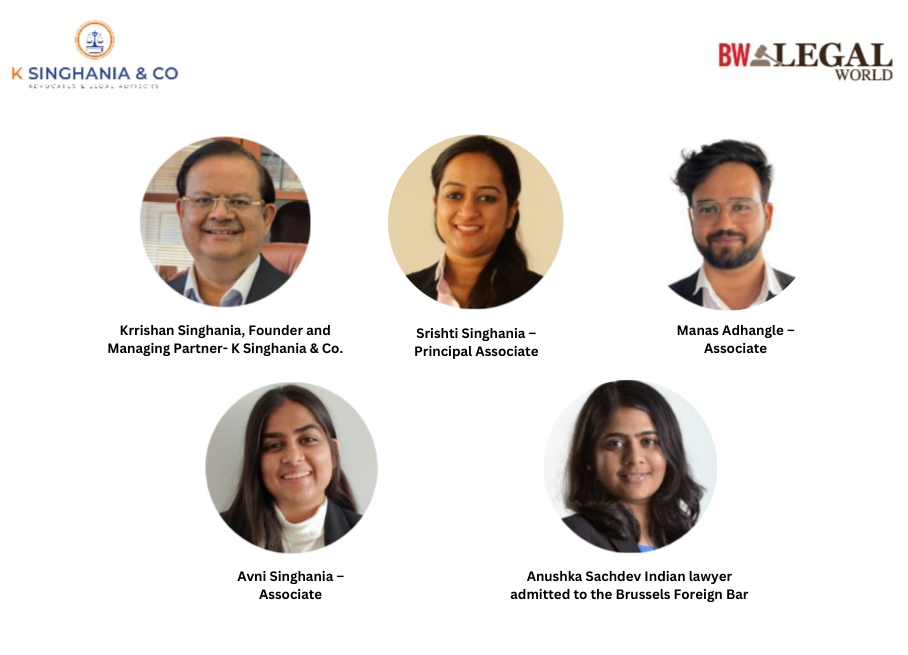

Protecting Brands In India And Europe: Comparison Of Trademarks Laws

Explore the key differences and similarities in trademark laws between India and Europe in this insightful article. Understand how these regulations impact brand protection and intellectual property rights in cross-border business operations.