Did you know that over 1.39 lakh companies were struck off in India between 2018–23 for non-compliance?

Why India’s Regulatory Landscape Demands Your Attention?

Foreign companies often enter India with optimism—attracted by its vast market, skilled talent, and long-term growth potential. Yet, many find themselves tripped up not by market dynamics, but by that translate into procedural missteps, structural oversights, and missed regulatory nuances —resulting in costly delays or even legal penalties.

In a regulatory environment as dynamic and layered as India, compliance isn’t just a checkbox— it’s your blueprint for sustainable success. From choosing the right entity structure and navigating FDI regulations, to protecting your IP and meeting annual filing deadlines, each step is a building block for long-term stability.

What This Guide Offers

✅ A clear, actionable compliance roadmap.

✅ Key regulatory insights across MCA, FEMA, SEBI, and RBI.

✅ Best practices to avoid common pitfalls.

The goal? Ensure you never pay a premium for delay—when diligence could be your strongest competitive advantage.

Your Roadmap to Staying Compliant in 2025

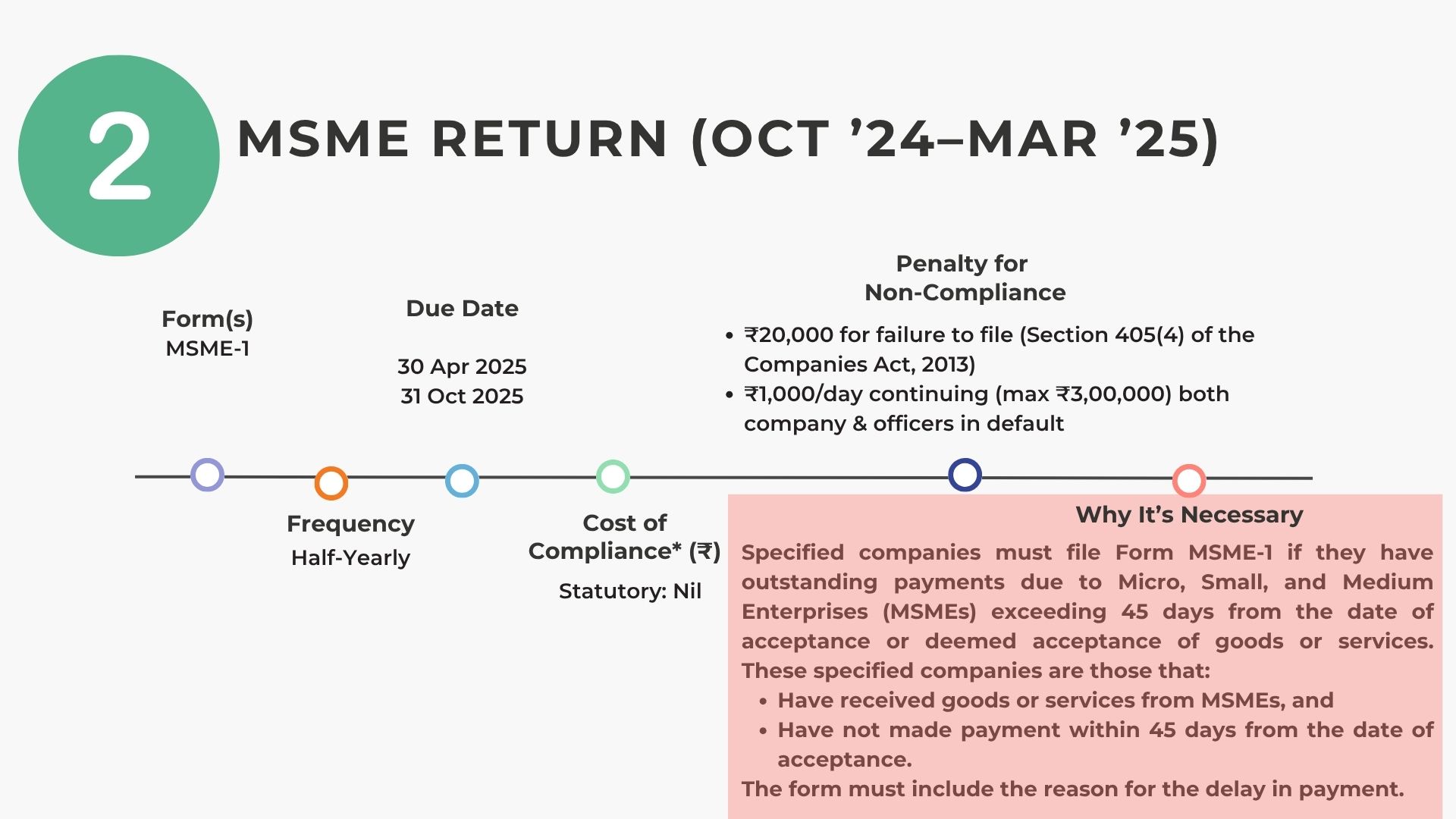

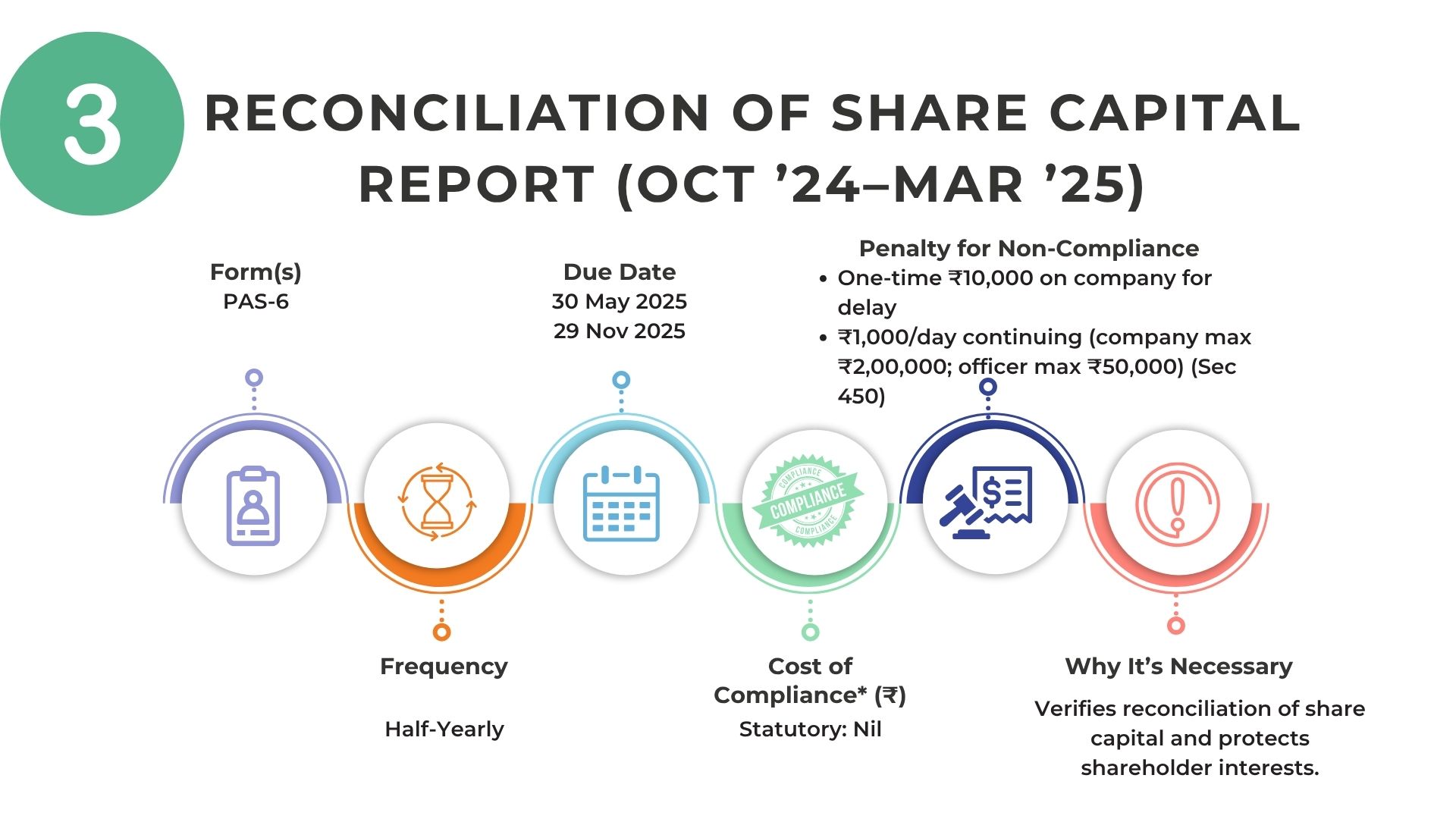

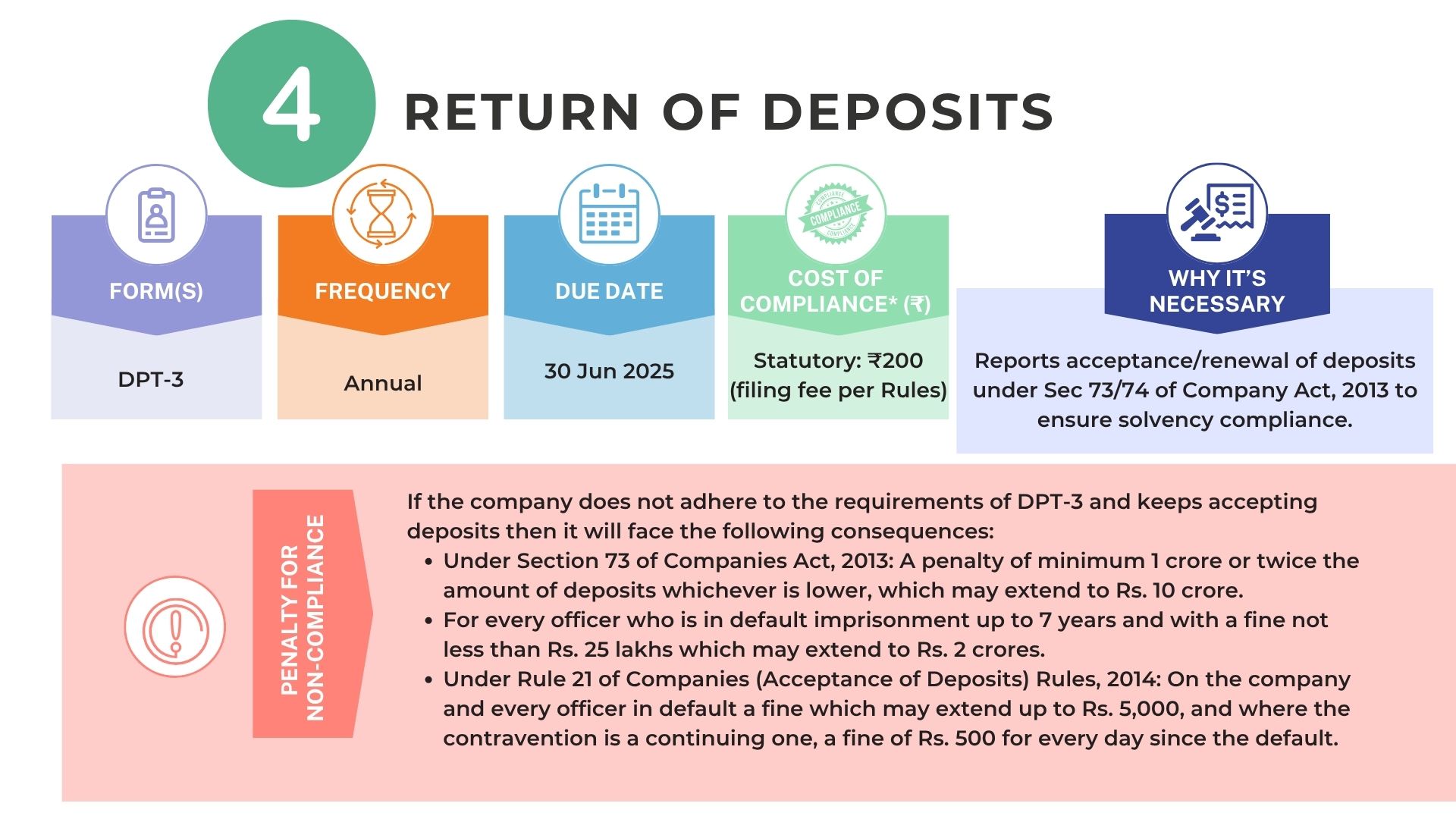

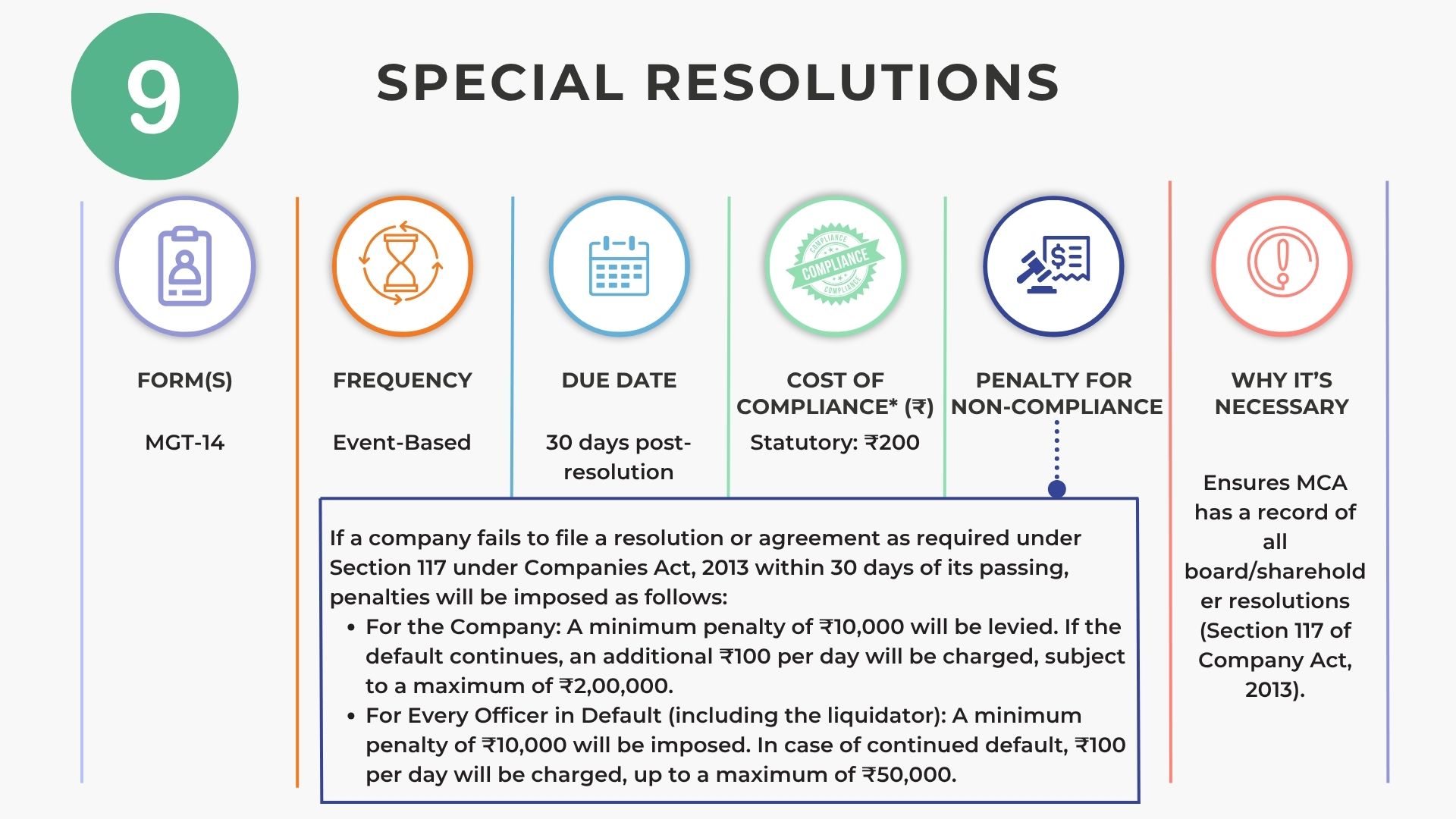

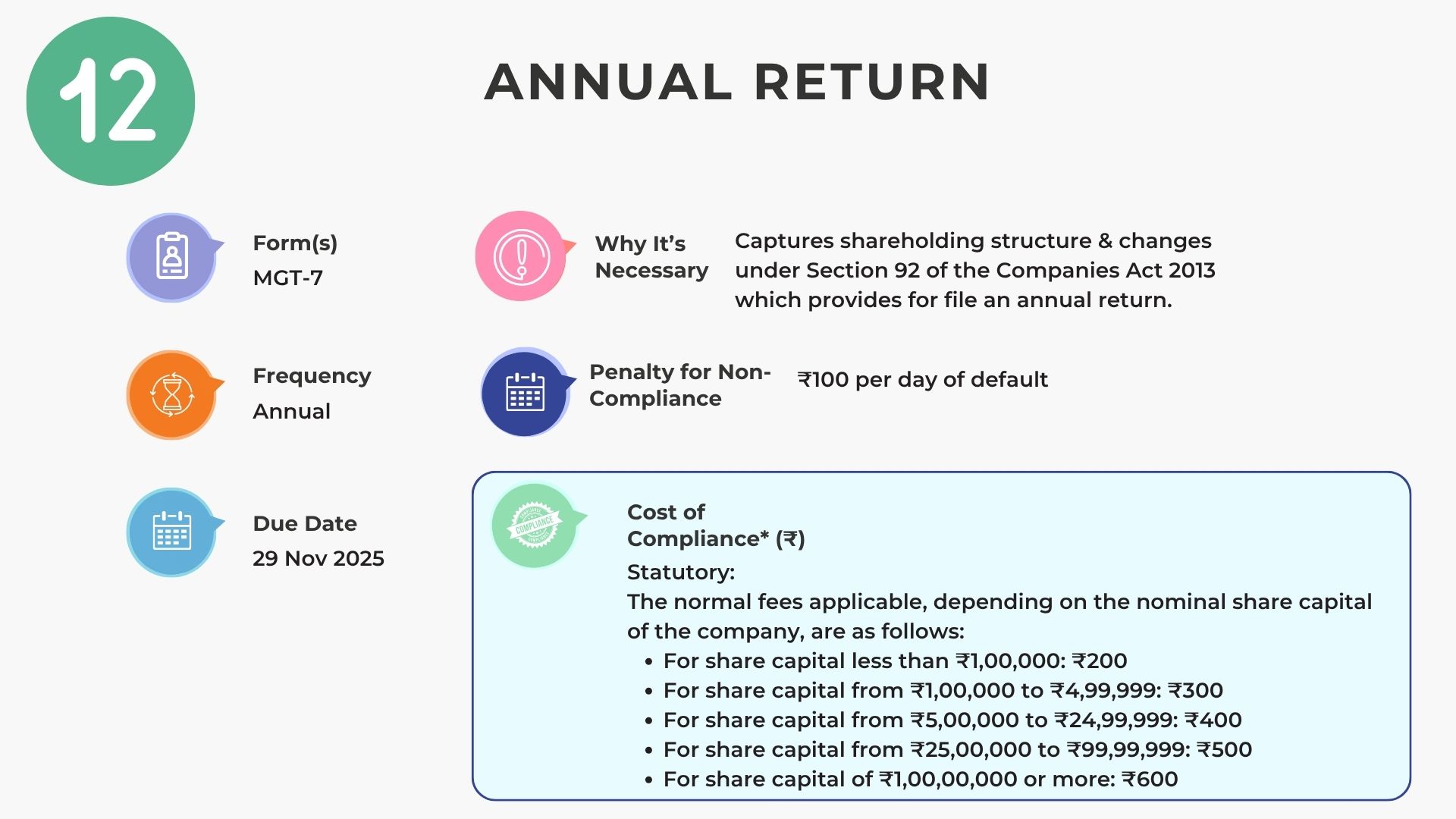

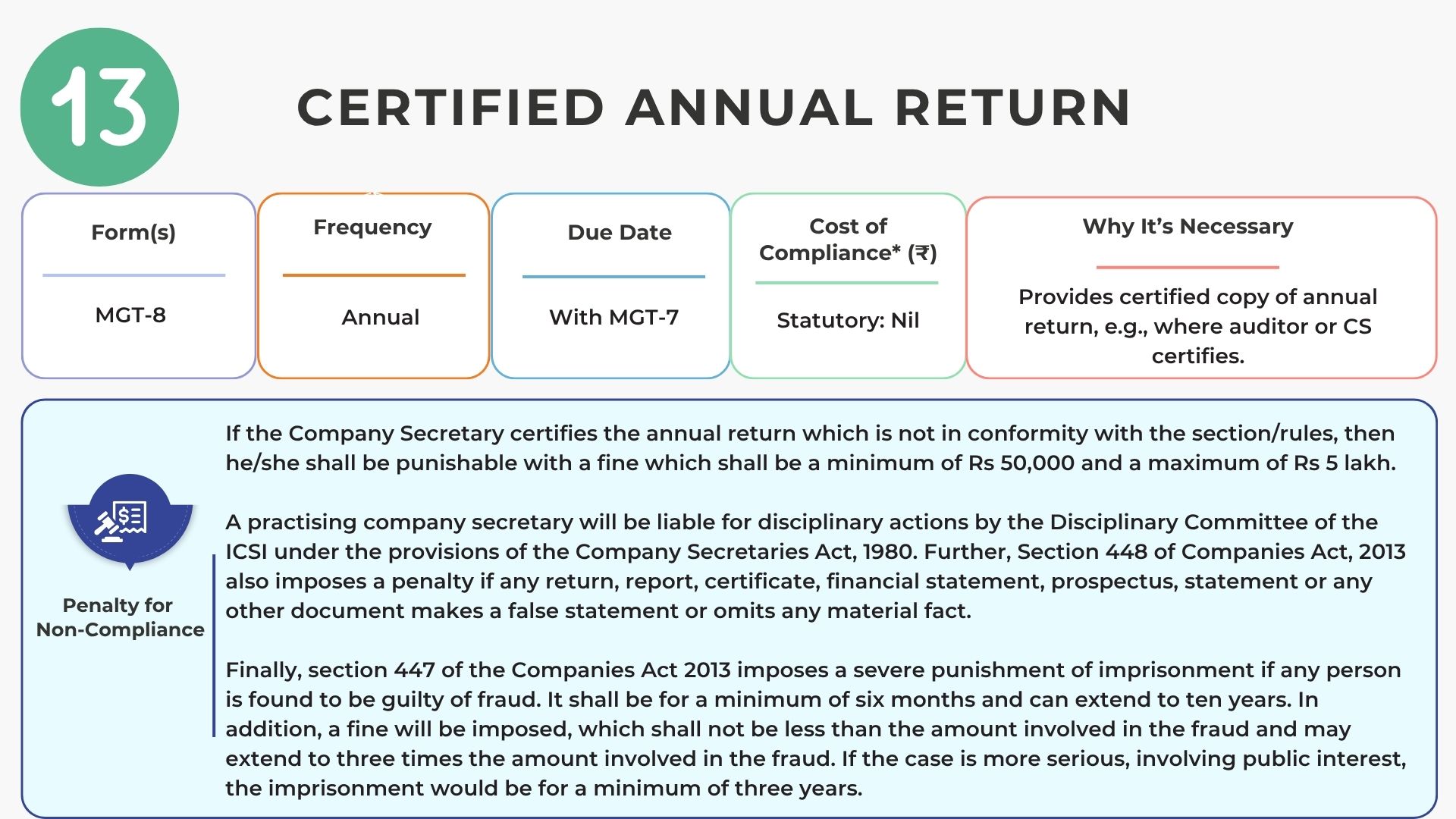

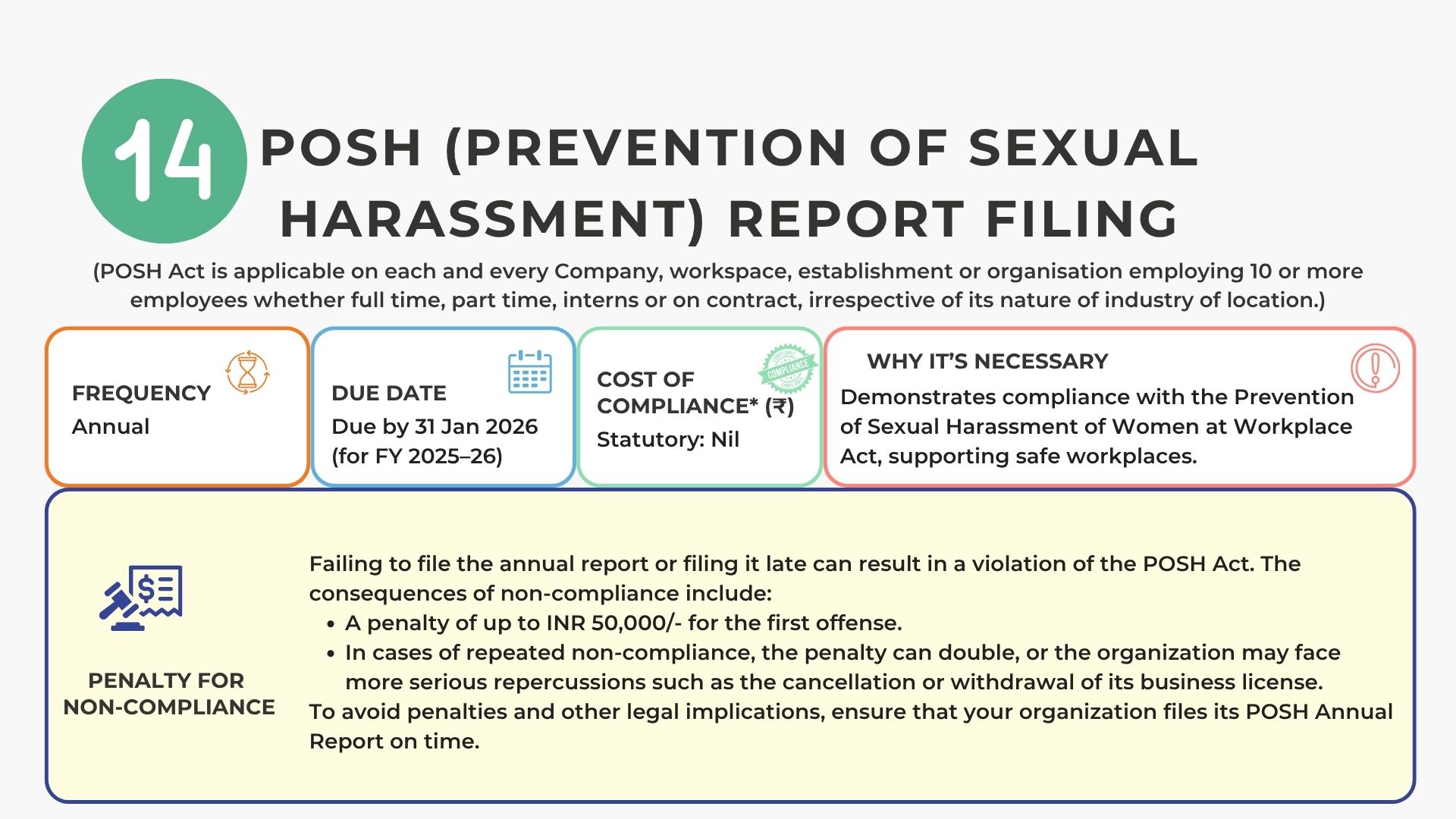

|

|

|

|

|

|

|

|

|

|

|

|

|

|

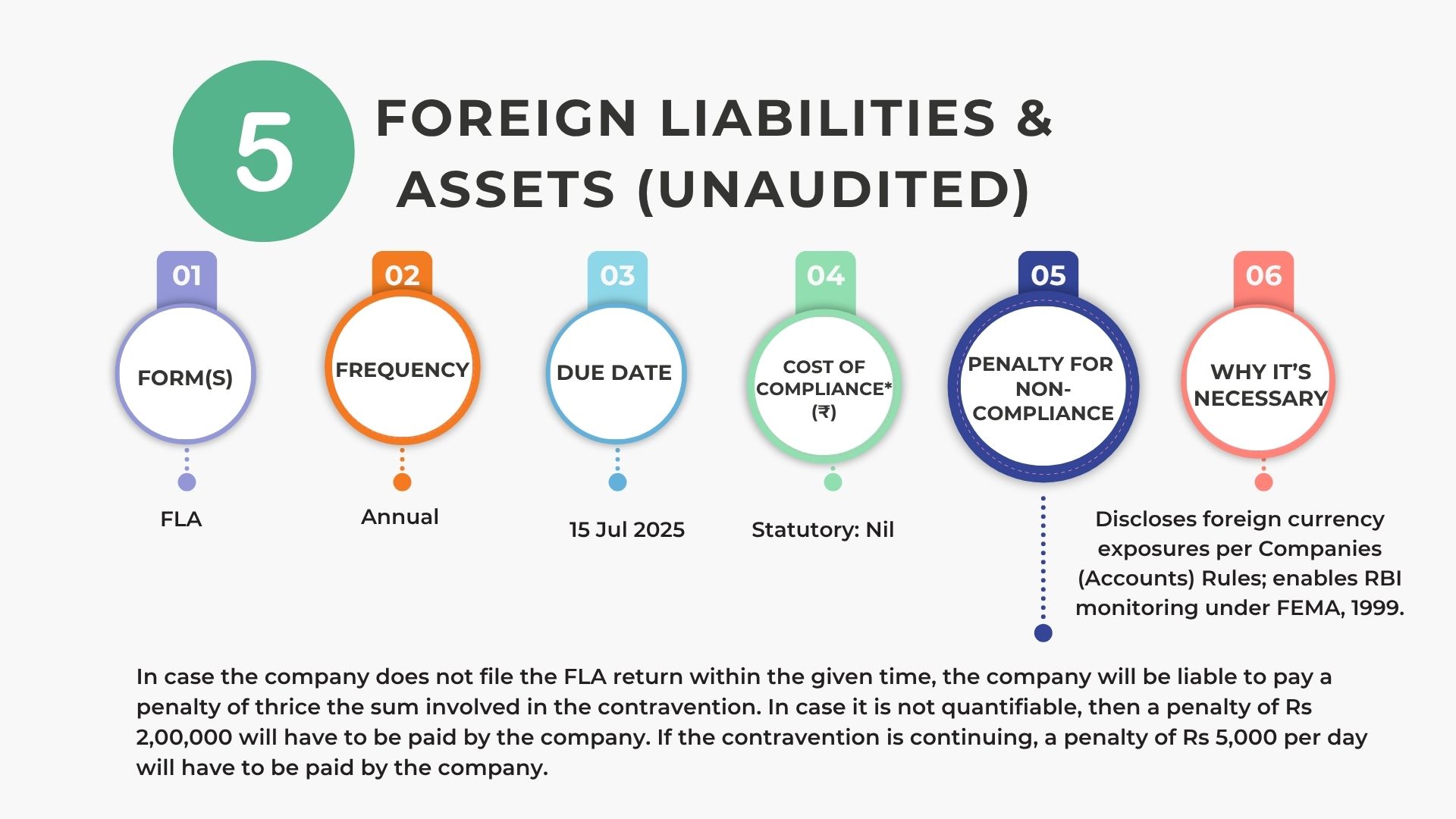

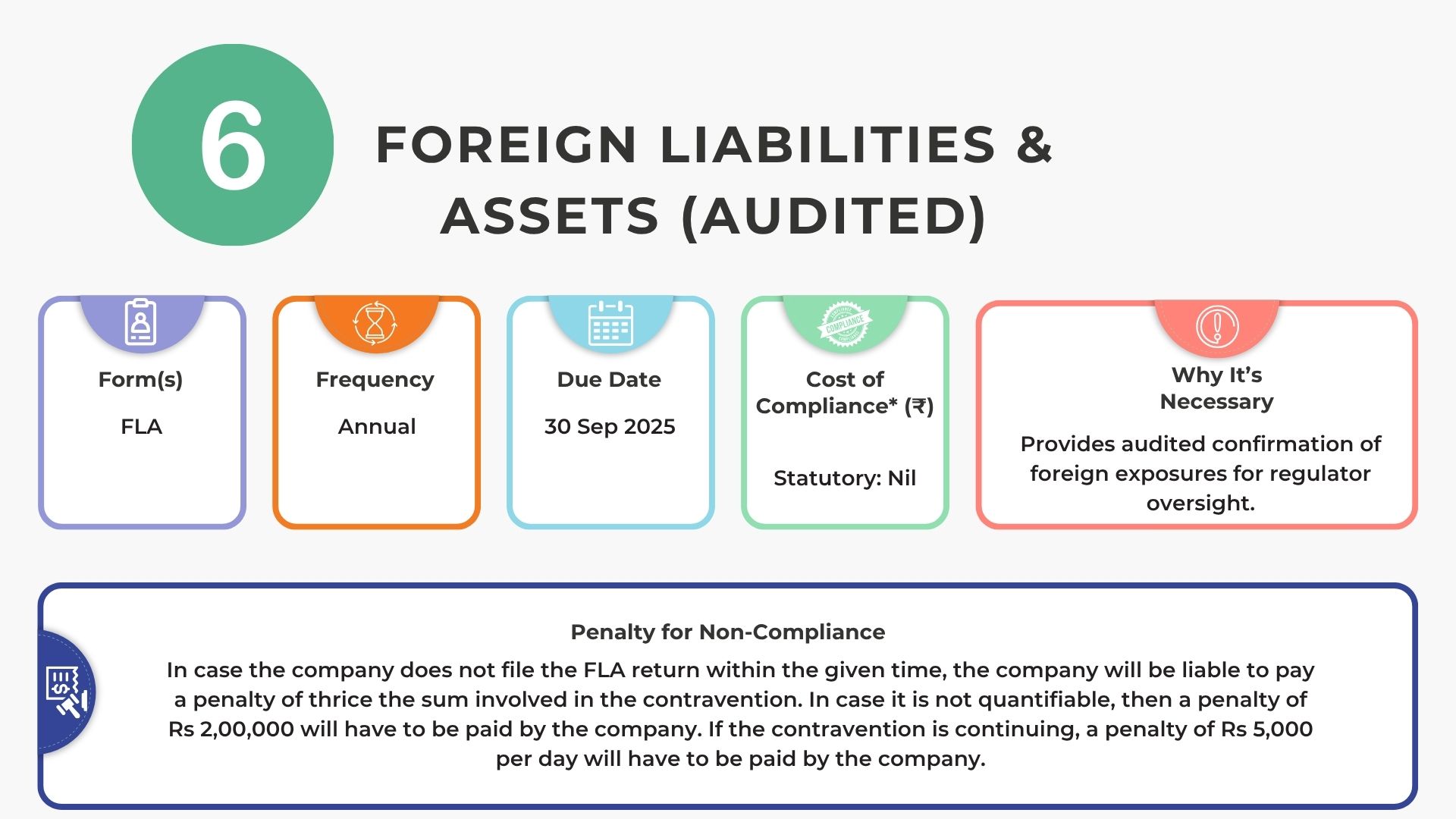

| *Statutory fee may be changed based on Share Capital |

Robust systems for statutory filings and governance aren’t just box-ticking—they’re vital to long-term operational stability and investor trust.

What Successful Foreign Companies Do Differently

- Centralize Compliance Calendar: Leverage cloud-based trackers with automated alerts

- Cross-Functional Collaboration: Foster alignment across Legal, Finance, HR & Operations

- Engage Experts From Day One: Involve local counsel and regulatory specialists early

- Quarterly Health-Checks: Conduct periodic internal audits to pre-empt breaches

What Needs to Happen — and When: Your 2025 Compliance Calendar

📅 2025 Compliance Calendar for Foreign Companies in India

The Strategic Advantage of Proactive Compliance

The true cost of oversight is never measured in fines alone—it’s quantified in lost opportunities, stalled projects, and eroded reputations. Foreign entities rarely falter because India’s market is impenetrable; they falter when they treat regulation as a last-minute hurdle instead of a strategic cornerstone. By embedding legal rigor into every phase—from entity formation and FDI analysis to IP fortification and continual regulatory upkeep—you erect a foundation that not only withstands scrutiny but fuels long-term growth.

For any international team evaluating India as your next growth story, our recommendation is clear: adopt a phase-wise, legally rigorous feasibility analysis that encompasses:

- Entity structuring and FDI scoping

- Trademark availability assessments and IP protections

- Director and shareholding compliance under FEMA and Company Law

- Tailored constitutional documents and high-impact operational contracts

- A comprehensive annual compliance roadmap across Company Law and FEMA

In today’s India, the first legal step isn’t simply procedural—it’s the defining moment that sets the trajectory for your entire business journey.