A shipping transaction is a commercial contract among the shipper (exporter), carrier, and consignee (importer) to facilitate the cross-border sale and transfer of goods via international waters. When an exporter or owner of goods intends to transport those goods by sea, the carrier, typically a shipping line, issues a Bill of Lading (BOL) to the exporter or shipper. The BOL is a critical document that outlines the quantity, type, and condition of the cargo being transported.

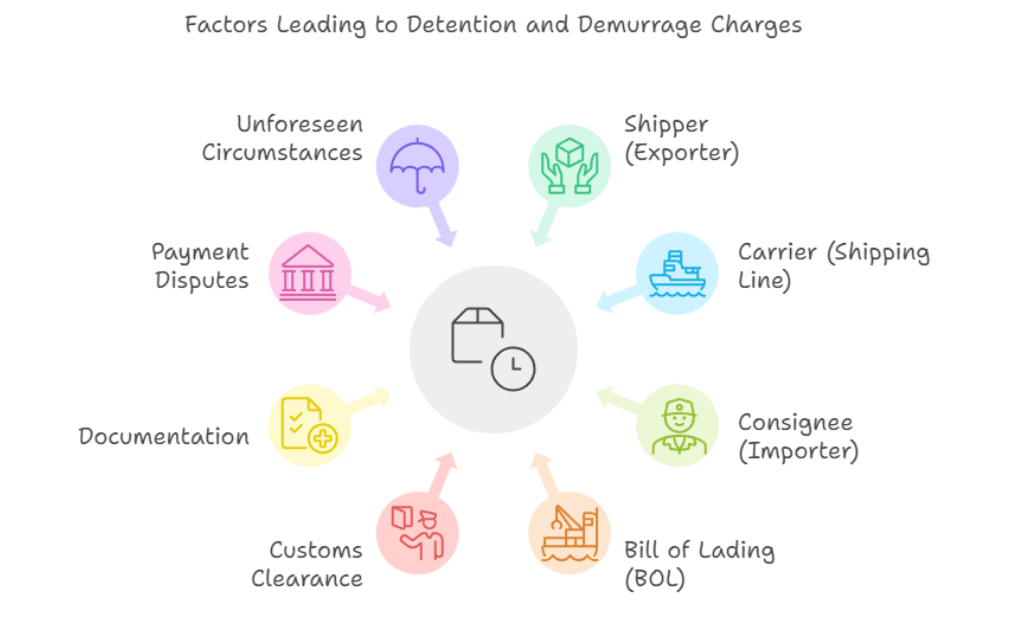

Once the shipment arrives at the destination port, the responsibility for timely discharge of the cargo typically lies with the importer. However, delays may arise due to various factors such as customs clearance issues, documentation errors, payment disputes, or other unforeseen circumstances. If the importer fails to discharge the cargo within the free period allowed by the port, they may be liable for detention and demurrage charges for the extended period during which the container continues to utilize port facilities.

The BOL outlines the terms and conditions related to various charges, such as detention, and specifies the obligations of both the shipper/exporter and consignee/importer to cover these expenses. Detention charges, in particular, are based on a private contract between the shipping line and the parties involved in the shipment.

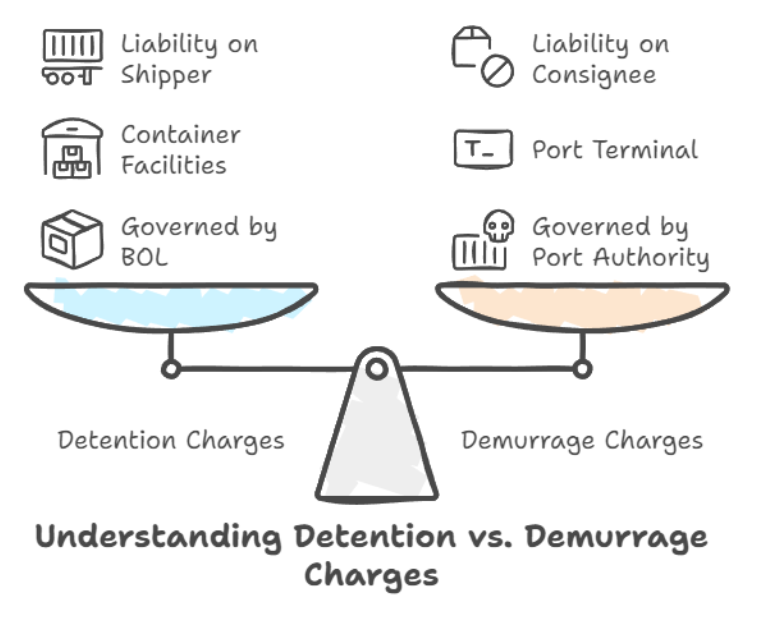

Detention and demurrage charges are often used interchangeably in international shipping, but they refer to distinct and different aspects of the shipping process. Although they are two sides of the same coin, they address different stages of the shipping journey.

Demurrage charges are imposed by port authorities or terminal agencies for the use of port and storage facilities. After a designated free period, these charges are applied to encourage shippers and exporters to promptly remove their goods once all compliance requirements are met. Delays in removing goods can occur due to customs clearance issues, documentation errors, payment disputes, or other unforeseen circumstances, which then result in demurrage charges.

Detention charges, on the other hand, are levied by shipping lines or container leasing companies to ensure the timely return of their containers. The terms and conditions outlined in the Bill of Lading (BOL) specify the free period during which these charges are not applicable, along with other guidelines for container usage.

Both terms involve fees imposed for the use of port or container facilities beyond the designated free period. Free period refers to the allotted time period, either stated in the BOL or determined by the port authorities to facilitate speedy offloading of cargo from the containers and timely release of the container to the Shipping line.

Demurrage charges are levied by port authorities for the use of port terminal and storage facilities. The Major Port Authorities Act, 2021, under Section 27(1), empowers designated major ports to establish rates and terms for the use of port services. Additionally, Section 30 of the same act grants port authorities the right to sell goods to recover outstanding demurrage charges.

At the state level, statutes such as the Maharashtra Maritime Board Act, 1996, and the Gujarat Maritime Board Act, 1981, provide similar authority to port authorities to impose demurrage charges and establish the necessary rates and conditions.

On the other hand, detention charges are governed by the terms and conditions between the shipping line and the consignee/shipper. These terms are outlined in the BOL issued by the carrier.

In any shipping transaction, it is crucial to understand when detention and demurrage charges accrue and on whom the liability is imposed. Detention charges typically accrue when the shipper/exporter or consignee/importer fails to return the shipping container within the stipulated free period, with the liability falling on the party responsible for container management. Conversely, demurrage charges are imposed by the port authority when goods remain in the port beyond the allowed free period, with liability generally assigned to the consignee/importer who has not cleared the goods in time.

During our research for this article, we examined the standard bills of lading from various shipping companies and found that their terms and conditions are generally uniform. The BOL in most cases, ensures that these charges are payable by the “merchant,” a term broadly defined to include the shipper, holder, consignee, receiver of the goods, or any person owning or entitled to the possession of the goods or the BOL itself. By accepting the BOL, the merchant agrees to pay any penalties or fines associated with these charges and to indemnify the carrier. The liability for such charges is often joint and several, meaning that any party named on the BOL can be held fully responsible for the payment. For the reader’s reference, we are reproducing the terms in a BOL of Hapag-Lloyd, relating to the imposition of detention charges:

“If Containers supplied by or on behalf of the Carrier are unpacked at the Merchant’s premises, the Merchant is responsible for returning the empty Containers (free of any dangerous goods placards, labels or markings), with interiors brushed and clean, to the point or place designated by the Carrier, his Servants or Agents, within the time prescribed. Should a Container not be returned within the time prescribed in the Tariff, the Merchant shall be liable for any detention, loss or expenses which may arise from such non-return.”

In a shipping transaction, the responsibility to discharge cargo from the port within the allotted time typically falls on the importer. However, even if the delay is not caused by the importer’s negligence or fault, they may still be held liable for demurrage and detention charges imposed by the port authorities.

Legal precedents highlight the complexity of determining liability in such situations. In Board of Trustees of The Port of Bombay vs. Indian Goods Supplying (AIR 1977 SUPREME COURT 1622), the Supreme Court of India addressed this issue by overturning a High Court ruling. The case revolved around whether an importer could avoid liability for demurrage charges when delays were not directly caused by their fault or negligence. The Supreme Court clarified that liability could still be imposed on the importer, even if the delay was due to factors beyond their control, such as customs clearance or other administrative processes.

The case involved Indian Goods Supplying Co., a partnership firm in Bombay that had imported three consignments of Chinese newsprint. The port authorities imposed demurrage charges on all three consignments due to delays in discharging the cargo. The importers contested the charges, arguing that they should not be held liable for the period when the containers were detained by import trade control authorities and customs, as these delays were beyond their control. Initially, the High Court ruled in favour of the importers, awarding them claims for the losses they had incurred due to the delays. However, the Supreme Court reversed this decision, holding that the importer was obligated to pay the demurrage charges regardless of the circumstances that led to the delay. This ruling underscore the principle that, even in cases where the delays are caused by factors outside the importer’s control, they may still be held accountable for charges related to the prolonged use of port facilities. The Court’s reasoning was grounded in the fact that the relevant authorities have the legal right to establish such rates under the provisions of the law, and this authority cannot be restricted under any circumstances. Consequently, the importer is obligated to pay demurrage charges unless there is clear evidence showing that the delay was caused by actions taken by the Port Authorities.

Similarly, in Mumbai Port Trust vs. M/S. Shri Lakshmi Steels and Ors. (AIR 2018 SC (SUPP) 443) , the High Court ruled that importers (in this case the Lakshmi steels, a proprietorship firm), who were harassed by the Directorate of Revenue Intelligence (DRI), Ludhiana as well as the customs authorities, should not be held liable for demurrage charges for the illegal action of the DRI and customs authorities.

The Court ordered the Port Trust to waive the demurrage charges imposed on the importers in lieu of the detention certificate issued by the customs and directed the DRI or customs authorities to bear the detention charges payable to the shipping line.

However, the Supreme Court overturned the High Court’s decision, ruling that even when the importer is not at fault, they remain solely responsible for paying demurrage charges.

The court further held that importers are liable for demurrage charges resulting from delays caused by the Directorate of Revenue Intelligence (DRI) and customs, as it is the importer’s responsibility to ensure the release of goods. Therefore, the importer becomes liable to pay the associated port charges. As discussed above, this position has been consistently reiterated by the Supreme Court in several rulings, reinforcing that port authorities are empowered to collect demurrage charges under the scope of statutory laws.

Additionally, regarding detention charges, the Supreme Court opined that these are governed by a private contract between the importer and the shipping line, and the High Court erred in directing the DRI or customs to bear such charges.

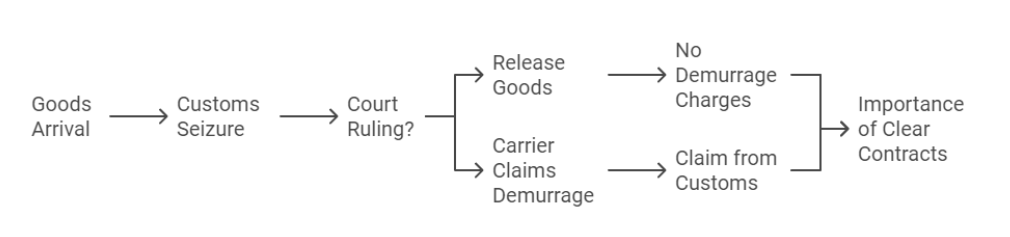

In the case of Shipping Corporation of India Ltd vs. C.L. Jain Woollen Mills & Ors. (AIR 2001 SUPREME COURT 1806), the Supreme Court clarified when an importer could be exempt from paying demurrage charges. The Court held that importers should not be held liable for demurrage charges only if the delay in releasing goods is due to unlawful detention or illegal actions by customs officials. This case highlighted the boundaries of liability when state actions interfere with the normal flow of shipping transactions.

The case involved C.L. Jain, the importer, who had contracted with The Shipping Corporation of India, the carrier, to import polyester filament yarn from Korea to India. According to the Bill of Lading, the carrier had a lien over the goods upon their arrival at the Delhi Port and was entitled to retain custody until the importer settled all outstanding debts, including demurrage fees. However, the situation escalated when Customs ordered the seizure of the imported goods under the carrier’s custody, alleging that the shipment had been brought in unlawfully and imposing penalties on the importer.

The Delhi High Court intervened by ruling that Customs’ seizure and penalty were unlawful as it prohibited another authority from rightfully claiming demurrage charges as per the contract between the shipping line and the shipper/importer. The High court ordered the release of the goods without requiring the importer to pay demurrage charges. However, the Supreme Court clarified that the Customs authority’s issuance of a detention certificate and the waiver of charges on the importer did not limit the carrier’s right to recover demurrage under the Bill of Lading. The Court further held that the Port Trust or the carrier could still claim these charges from the customs authorities, as there was no provision under the Customs Act that exempted them from liability due to their illegal activities.

Understanding the nuances of detention and demurrage charges is important to effectively negotiate commercial contracts in the shipping industry. By grasping these concepts and their specific occurrences, parties can better anticipate potential liabilities and make informed decisions, such as determining how responsibility for these charges should be allocated. It is imperative for parties to implement measures in advance to minimize delays thereby avoiding the swords of detention and demurrage falling on them. This foresight will help avoid unnecessary financial burdens that may arise from mismanagement or delays in the shipping process, ultimately protecting the interests of all parties involved and promoting smoother, more efficient shipping operations.

A well-drafted commercial contract or agreement of sale between the shipper/exporter and the importer/consignee should include detailed terms and conditions addressing these issues. For instance, the contract should clearly outline the importer’s liability in the event of delays that lead to detention or demurrage charges. Additionally, it should include an indemnity clause requiring the exporter to reimburse the importer if such charges arise due to the exporter’s fault or negligence and vice versa. Including such provisions not only clarifies each party’s obligations but also helps to prevent disputes and ensures a more predictable and manageable shipping process.