In this edition, we bring you the latest updates and key judgments shaping insolvency and bankruptcy jurisprudence in India. From clarifications on liquidation timelines to the applicability of moratoriums, and from creditor claims to issues surrounding financial service providers, these cases provide valuable insights into the evolving landscape under the Insolvency and Bankruptcy Code (IBC). Dive into the summaries below to stay informed on the most recent decisions impacting corporate insolvency resolution and liquidation processes.

Whether the timelines under Clause 12 of Schedule I of the Liquidation Regulations are directory or mandatory?

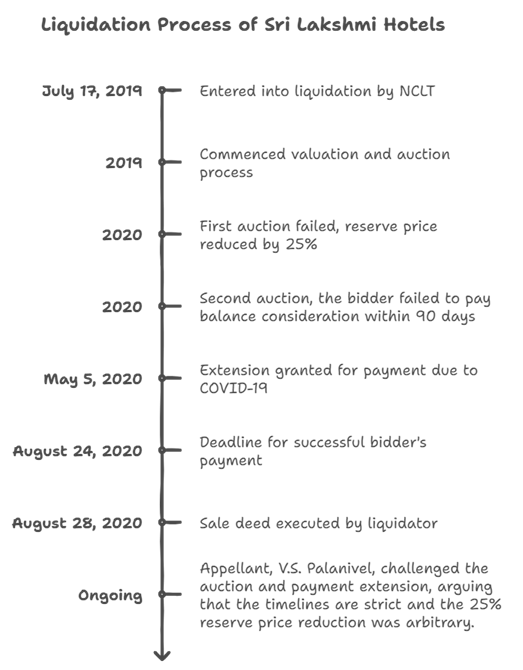

V.S. Palanivel v. P. Sriram CS, Liquidator, Supreme Court Judgment dated Asugust 28, 2024

Facts

Sri Lakshmi Hotels Pvt. Ltd. entered into liquidation on July 17, 2019, following an order passed by the NCLT, Chennai. In accordance with the IBBI (Liquidation Process) Regulations, 2016, the liquidator commenced the valuation and auction process. The first auction failed, and the liquidator reduced the reserve price by 25%, as per Schedule I of the regulations. In the second auction, KMC Speciality Hospitals (India) Ltd. emerged as the sole successful bidder. However, the successful bidder failed to pay the balance sale consideration within 90 days, as required under the Liquidation Regulations.

Subsequently, the bidder approached the NCLT, Chennai, seeking an extension for payment due to difficulties caused by the COVID-19 pandemic. The tribunal granted the extension on May 5, 2020, allowing the bidder to complete the payment on August 24, 2020. The liquidator executed the sale deed on August 28, 2020.

The appellant, V.S. Palanivel i.e. the Suspended Director of Corporate Debtor, challenged both the auction proceedings and the extension granted for payment, arguing that the timelines under Clause 12 of Schedule I of the Liquidation Regulations are sacrosanct and no extension should have been permitted. He also contended that reducing the reserve price by 25% was arbitrary.

Key Issues

The case raised several legal issues:

- Are the timelines under Clause 12 of Schedule I of the Liquidation Regulations mandatory or directory?

- Was the extension granted to the successful bidder for payment of the balance sale consideration lawful?

- Was the liquidator justified in reducing the reserve price by 25%?

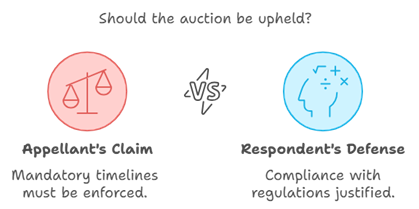

Arguments of the Appellant

The appellant, V.S. Palanivel, argued that the timelines for payment under Clause 12 of Schedule I of the Liquidation Regulations are mandatory in nature and cannot be relaxed. According to him, failure to make the payment within the 90-day period should have resulted in the cancellation of the sale, and no extension should have been granted. He also claimed that the reduction in the reserve price by 25% was arbitrary, considering the higher valuation of the property in question. The appellant sought to have the entire auction process set aside, along with the sale deed executed in favor of the successful bidder.

Arguments of the Respondent

The respondent, P. Sriram CS, the liquidator, countered these arguments by stating that the auction process was conducted in compliance with the IBC and the IBBI Regulations. He argued that the delay in payment was due to the unforeseen circumstances of the COVID-19 pandemic, which constituted a force majeure event. Furthermore, the liquidator cited the Supreme Court’s suo moto writ petition (Civil No. 3 of 2020), which extended all statutory timelines, including those under the IBC, in light of the pandemic. He contended that the reserve price reduction was made in accordance with Clause 4A of Schedule I under Regulation 33 of the Liquidation Regulations, and the advice of the Stakeholders Consultation Committee (SCC) is not binding on the liquidator.

Supreme Court’s Decision

The Supreme Court, while partially allowing the appeal, upheld the auction process but provided some crucial clarifications on the issues at hand.

- Timelines under Clause 12 of Schedule I: The Court observed that Clause 12 of Schedule I, which mandates the payment of the balance sale consideration within 90 days, is indeed mandatory. This clause prescribes a consequence for non-compliance: the sale should be canceled if the bidder fails to pay within the stipulated time. However, the Court recognized the unprecedented disruption caused by the COVID-19 pandemic and upheld the extension granted to the successful bidder under Regulation 47A, which was inserted to provide relief for delays caused by the pandemic. The Court emphasized that while the liquidator has no power to condone delays beyond 90 days under normal circumstances, the exceptional conditions warranted flexibility.

- Reduction of the Reserve Price: The Court upheld the liquidator’s decision to reduce the reserve price by 25%, noting that this was in line with Clause 4A of Schedule I under Regulation 33. The liquidator has the discretion to reduce the reserve price to facilitate a successful auction, and this action was justified given the failure of the first auction. The advice of the SCC, while relevant, is not binding on the liquidator, and the Court found no arbitrariness in the price reduction.

- Penalty Imposed on the Successful Bidder: Despite upholding the extension granted to the successful bidder, the Court recognized the delay in payment as a significant issue. To address this, it directed the successful bidder to pay an additional sum of INR 5 Crores, which represents 50% of the difference between the original liquidation value and the reserve price set for the second auction. The bidder was also directed to pay interest at 9% per annum on this amount from March 26, 2020, until the date of payment.

K S & Co Comment

In this judgment, the Supreme Court underscores the mandatory nature of the payment timelines prescribed under Clause 12 of Schedule I of the

Liquidation Regulations. Even when extending the benefit of Regulation 47A, the Court mandates that the Successful Bidder pay interest for non-compliance with the stipulated timelines under the Liquidation Regulations.

Moratorium Can’t Be a Shield to Defeat Legitimate Claims of the Creditors

Punjab National Bank and Anr v. Mohita Indrayan, NCLT, Chandigarh

Facts

M/s Indian Clothing League Private Limited (corporate debtor) took loans amounting to ₹20 crores from Punjab National Bank and ₹15 crores from Allahabad Bank (now merged with Indian Bank). Ms. Mohita Indrayan provided a personal guarantee for the debts owed by the corporate debtor.

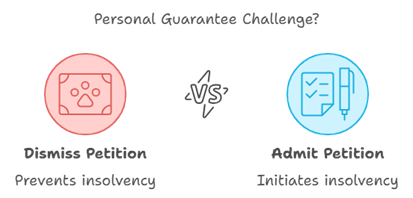

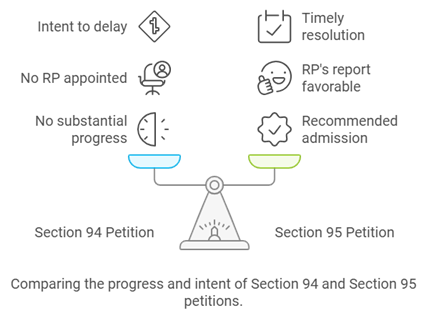

On September 1, 2022, Ms. Indrayan filed a petition under Section 94 of the Insolvency and Bankruptcy Code (IBC) to initiate insolvency resolution against herself, which triggered an interim moratorium under Section 96 of the IBC. Later, on May 20, 2023, the banks filed a petition under Section 95 of the IBC against Ms. Indrayan, seeking insolvency resolution against her as the personal guarantor.

Ms. Indrayan filed IA No. 2727/2023, seeking dismissal of the banks’ petition under Section 95 of the IBC. IA No. 2974/2023 was filed by the Resolution Professional (RP), recommending admission of the banks’ petition under Section 95.

Key Issues

Whether a personal guarantor who files a petition under Section 94 of the IBC can claim the benefit of interim moratorium under Section 96 to prevent creditors from pursuing insolvency proceedings under Section 95 of the IBC?

Judgment

The NCLT, Chandigarh, emphasized that the personal guarantor, Ms. Mohita Indrayan, had not acted in good faith by filing the petition under Section 94 of the Insolvency and Bankruptcy Code (IBC). Although such a petition triggers an interim moratorium under Section 96 of the IBC, the tribunal ruled that this protection cannot be misused as a tactic to stall legitimate insolvency proceedings initiated by creditors.

The NCLT observed that:

- No substantial progress was made in the Section 94 petition filed by the personal guarantor.

- No Resolution Professional (RP) was appointed despite significant time having passed, and repeated adjournments were sought.

- The conduct of the personal guarantor indicated an intention to delay the insolvency proceedings initiated by the banks under Section 95 of the IBC.

The tribunal stated:

“While the interim moratorium under Section 96 of the IBC is triggered by a Section 94 petition, it cannot serve as a shield to defeat the legitimate claims of creditors. If such misuse were permitted, the primary objectives of the IBC—maximization of asset value and timely insolvency resolution—would be compromised.”

The NCLT further clarified:

“If the Section 94 application is merely used to avoid or dodge the insolvency process initiated by the financial creditors, the personal guarantor cannot be granted the benefit of interim moratorium under Section 96 of the Code.”

Since the Section 94 petition had not progressed and was filed with the intent to delay creditor actions, the NCLT held that it was necessary to proceed with the petition filed under Section 95 by the banks to ensure a fair and timely insolvency resolution. The tribunal acknowledged that the RP’s report on the banks’ petition under Section 95 recommended admission of the petition and initiation of the insolvency process.

The tribunal concluded:

“In the interest of justice, the application filed under Section 95 of the Code has to proceed, as both applications aim to resolve the insolvency of the personal guarantor.”

Thus, the NCLT admitted the creditors’ petition under Section 95 of the IBC and initiated the insolvency resolution process against Ms. Mohita Indrayan, dismissing any objections based on the interim moratorium claimed under Section 96.

K S & Co Comment

The NCLT made it clear that moratorium under Section 96 cannot be misused as a shield to prevent legitimate claims of creditors. The insolvency framework under the IBC is designed to ensure swift resolution and avoid undue delays. By failing to progress the petition filed under Section 94, the personal guarantor demonstrated a lack of good faith. Thus, the NCLT admitted the banks’ petition under Section 95 and initiated the insolvency process, upholding the principle that the IBC’s primary purpose is to protect creditors’ interests and maximize the value of assets.

This judgment reinforces that insolvency proceedings should not be obstructed by frivolous claims or misuse of procedural safeguards like moratoriums, ensuring that the resolution process remains fair and efficient.

Resolution Professional Can Only Entertain Claims Due As Of CIRP Commencement Date

Gujarat Urja Vikas Nigam Limited vs. Udayraj Patwardhan (Resolution Professional of Adel Landmarks Pvt. Ltd.)

Facts

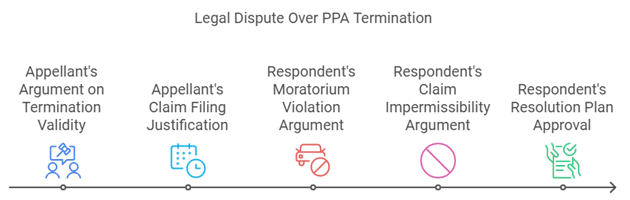

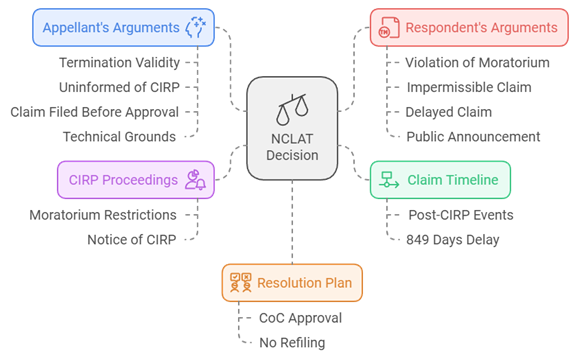

Gujarat Urja Vikas Nigam Limited (the “Appellant”), a government undertaking responsible for power purchase and sale in Gujarat, entered into a Power Purchase Agreement (PPA) with Era Infrastructure Limited (later renamed Adel Landmarks Pvt. Ltd.) for wind power. However, since March 2015, the Corporate Debtor failed to supply power as required, leading to a notice of default issued by the Appellant on June 15, 2019. The Appellant subsequently terminated the PPA on November 25, 2019, and demanded compensation of INR 3.36 crore. Meanwhile, the Corporate Debtor entered into the Corporate Insolvency Resolution Process (CIRP) on December 5, 2018, which the Appellant claimed to have learned about later. The Appellant filed its claim with the Resolution Professional (RP) but was rejected due to the moratorium under Section 14 of the Insolvency and Bankruptcy Code (IBC). The Appellant’s claim, filed on July 1, 2021, was further denied due to its lateness and the CIRP moratorium.

Key Issues

- Whether the Appellant had the right to terminate the PPA after the initiation of the CIRP process and whether such termination was valid under the IBC.

- Whether the Appellant’s claim for INR 3.36 crore, based on the termination of the PPA, could be admitted after the initiation of CIRP.

- Whether the delay of 849 days in filing the claim by the Appellant could still be considered for compensation.

- Whether claims arising from events occurring after the CIRP date could be admitted by the Resolution Professional.

Arguments of the Appellant

- The Appellant argued that the termination of the PPA was valid due to the Corporate Debtor’s default, as per Article 9 of the PPA. They asserted that Section 14 of the IBC did not prevent the termination of the PPA as it did not involve financial default but rather operational failure.

- The Appellant contended that they were not informed of the CIRP proceedings and that the delay in filing the claim was justified since the initiation of CIRP was unknown to them.

- They emphasized that their claim was filed before the approval of the Resolution Plan and that the Adjudicating Authority’s earlier direction on June 6, 2019, allowed claims despite delays.

- The Appellant argued that their claim should not be dismissed on technical grounds and cited various judgments, including Gujarat Urja Vikas Nigam Limited v. Amit Guptaand Tata Consultancy Services Limited v. Vishal Ghisulal Jain, which support their stance on termination during CIRP.

Arguments of the Respondent (Resolution Professional)

- The Respondent countered that the PPA termination by the Appellant occurred during the CIRP and was in violation of the moratorium imposed under Section 14 of the IBC. This moratorium barred any termination of agreements or contracts, unless the termination was due to payment defaults, which was not the case here.

- The Respondent maintained that the claim filed by the Appellant in Form B was impermissible as it pertained to events that occurred after the commencement of CIRP. The claim was considered a recovery proceeding, not an operational debt.

- It was further argued that the Appellant’s delayed claim, filed 849 days after the CIRP commencement date, could not be entertained. The Respondent had made public announcements about the CIRP, and the Appellant was expected to act diligently.

- The Respondent cited the approval of the Resolution Plan by the Committee of Creditors (CoC) on September 15, 2022, asserting that no further claims could be admitted after such approval.

NCLAT’s Decision

The National Company Law Appellate Tribunal (NCLAT) dismissed the appeal, holding that:

- The Appellant’s termination of the PPA during the CIRP violated Section 14 of the IBC, which prohibits such actions once a moratorium is in place. The tribunal clarified that the moratorium under Section 14(1) restricts proceedings against the Corporate Debtor, including the termination of agreements.

- The Appellant’s claim was filed well beyond the prescribed timeline, and the Resolution Professional was correct in rejecting the claim as it arose from events that occurred after the CIRP initiation date. Claims pertaining to post-CIRP events could not be admitted.

- The Tribunal supported the Respondent’s position that the public announcement of CIRP was sufficient notice, and the Appellant’s plea of being unaware of CIRP proceedings was unconvincing.

- It was ruled that the approval of the Resolution Plan by the CoC could not be undone, and the Appellant could not refile claims once the Resolution Plan was submitted for adjudication.

- The appeal was found devoid of merit and was dismissed without costs.

K S & Co Comment

In our view, the NCLAT’s decision in this case is well-grounded and reinforces the time-bound nature of the IBC. The order rightly underscores the importance of adhering to statutory timelines for submitting claims, ensuring that the resolution process moves forward efficiently. If claims were allowed to be filed beyond the prescribed deadlines, it would compromise the primary objective of the IBC, which is to facilitate swift resolution and avoid endless litigation.

NCLT Hyderabad Declares Stock Brokers As Financial Service Provider, Petition Under Section 9 Not Maintainable

Kapston Facilities Management Ltd. v. Karvy Stock Broking Ltd.

Key Legal Principle:

A financial service provider does not fall within the definition of a corporate person under Section 3(7) of the Insolvency and Bankruptcy Code (IBC), and therefore, a Corporate Insolvency Resolution Process (CIRP) cannot be initiated against such an entity under Section 9 of the IBC.

Facts

The petitioner, Kapston Facilities Management Ltd. (Operational Creditor), filed an insolvency petition against Karvy Stock Broking Ltd. (Corporate Debtor/Respondent), a registered stockbroker with SEBI, for outstanding payments related to security and housekeeping services.

The agreement between the parties was executed on April 20, 2011, where the Operational Creditor provided services to Karvy Stock Broking Ltd. and its group companies.

The first payment default occurred on October 1, 2019. On June 28, 2021, the Operational Creditor issued a demand notice claiming Rs. 1,07,63,333 as unpaid dues.

The respondent argued that being a financial service provider, it is not considered a corporate person under the IBC, and therefore, CIRP cannot be initiated against it.

Issues

Whether the respondent, Karvy Stock Broking Ltd., being a financial service provider, can be subjected to CIRP under Section 9 of the IBC, and whether the operational creditor’s claim crossed the threshold limit required to file the petition.

Arguments of the Appellant

The Operational Creditor argued that Karvy Stock Broking Ltd. was liable to pay both the principal amount and interest under the MSME Act, which entitled the Operational Creditor to claim interest for delayed payments. They also argued that the SEBI’s order against Karvy did not exempt it from insolvency proceedings.

Arguments of the Respondent

The respondent argued that they are a financial service provider as per Section 3(17) of the IBC and cannot be considered a corporate person. Therefore, no CIRP can be initiated against them. They also contended that the claim amount, excluding the interest, fell below the threshold limit required under Section 4 of the IBC. Furthermore, 25 invoices fell within the exclusion period of Section 10A of the IBC, for which CIRP cannot be initiated.

Judgment

The NCLT ruled in favor of the respondent, Karvy Stock Broking Ltd., and dismissed the petition on the following grounds:

Non-Applicability of CIRP

The respondent is a financial service provider, and as per Section 3(7) of the IBC, such entities do not qualify as corporate persons. Consequently, CIRP cannot be initiated against them under Section 9 of the IBC.

The Tribunal relied on the judgment in Globe Capital Market Ltd. v. Narayan Securities Ltd., which established this principle.

Threshold Limit

The NCLT noted that if the interest component is excluded from the total claim, the remaining principal amount falls below the threshold limit of Rs. 1 crore, as required under Section 4 of the IBC. Additionally, a substantial portion of the claim (25 invoices) fell within the Section 10A period, which prohibits initiating CIRP during the COVID-19 pandemic period.

Invalid Claim for Interest

The contract between the parties did not stipulate payment of interest on delayed payments. The operational creditor’s claim for interest was thus rejected, and they were not entitled to claim under the MSME Act since they were not registered under it.

K S & Co Comment

This case highlights the importance of knowing who qualifies under the Insolvency and Bankruptcy Code (IBC). The dismissal of the petition against Karvy Stock Broking Ltd. shows that financial service providers, like stockbrokers, cannot be taken through the CIRP process under the IBC. The Tribunal also carefully looked at whether the claim met the required threshold and noted that many of the invoices were protected under Section 10A due to the COVID-19 period. Additionally, since there was no agreement for interest on delayed payments, the claim for interest was rejected. This decision emphasizes the need for clear agreements and a solid understanding of the law before filing a case.

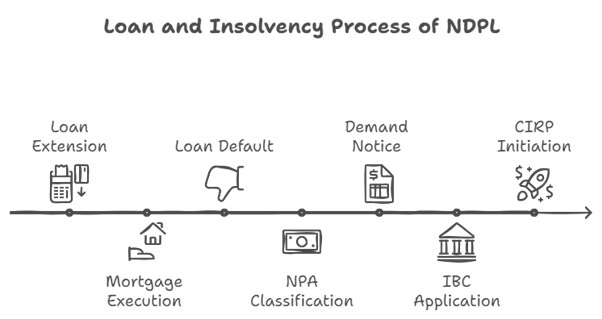

Co-Borrower Shares Similar And Equal Responsibility Under Loan Agreement: NCLAT New Delhi

Amit Narang v. Aditya Birla Finance Ltd. and Anr.

Key Legal Principle

A co-borrower is equally liable under a loan agreement, sharing the same responsibility as the primary borrower. Corporate Insolvency Resolution Process (CIRP) can be initiated against both the primary borrower and the co-borrower under the Insolvency and Bankruptcy Code (IBC).

Facts

Aditya Birla Finance Ltd. (Financial Creditor) extended a loan of ₹11.50 crores to the corporate debtor, Narang Developers Pvt. Ltd. (NDPL), which acted as a co-borrower alongside the primary borrowers, Csango Industries Pvt. Ltd. and Pacific Link Pvt. Ltd.

NDPL executed a mortgage over its assets as security in favor of the creditor through agreements in 2016 and 2018.

NDPL defaulted on the loan repayment, and its account was classified as a Non-Performing Asset (NPA) on 16/06/2019. Aditya Birla Finance Ltd. sent a demand notice under the SARFAESI Act.

Following the default, the creditor filed an application under Section 7 of the IBC, leading to the initiation of CIRP against NDPL by the National Company Law Tribunal (NCLT), Mumbai, on 28/03/2024.

Key Issues

Whether a co-borrower is equally and severally liable under a loan agreement, making it possible for CIRP to be initiated against the co-borrower, NDPL.

Arguments of the Appellant

Amit Narang, the suspended director of NDPL, argued that the loan was given to Csango Industries Pvt. Ltd. and Pacific Link Pvt. Ltd., not NDPL, and hence NDPL should not be held responsible for the default. He also claimed the loan documents were not properly stamped, rendering them invalid.

Arguments of the Respondent

Aditya Birla Finance Ltd. argued that the co-borrower, NDPL, shared equal responsibility for the loan repayment, and CIRP could be initiated against NDPL in line with the terms of the agreement.

NCLAT’s Analysis

- Liability of Co-borrowers: The NCLAT referred to the precedent set in State Bank of India vs. Athena Energy Venture Pvt. Ltd., where it was established that CIRP can be initiated against both the primary borrower and co-borrower. The Tribunal reiterated that the co-borrower’s obligations are co-extensive with that of the primary borrower.

- Stamping of Documents: The Tribunal rejected the appellant’s plea regarding insufficiently stamped documents, citing the Supreme Court ruling in NN Global Mercantile (P) Ltd. vs. Indo Unique Flame Ltd., which held that insufficient stamping is a curable defect. Such documents are not void, only inadmissible until properly stamped.

- SARFAESI Proceedings: The Tribunal emphasized that declaring an account as an NPA under the SARFAESI Act is an independent proceeding that does not affect the initiation of CIRP under the IBC.

- Loan as Financial Debt: The Tribunal rejected the argument that the loan did not qualify as a financial debt under Section 5(8) of the IBC, noting that the loan had been advanced at an annual interest of 15%, representing the time value of money.

NCLAT’s decision

The NCLAT upheld the decision of the NCLT, ruling that:

- The co-borrower (NDPL) shared equal and the same responsibility under the loan agreement as the primary borrowers.

- Insufficient stamping of loan documents is merely a technical deficiency and does not invalidate the agreement.

- The CIRP was rightly initiated against NDPL, and the Section 7 application was admitted based on co-borrower liability.

K S & Co Comment

This case reaffirms that co-borrowers share equal responsibility with the primary borrower under a loan agreement. CIRP can be initiated against either party, depending on the terms of the facility agreement. The ruling highlights the importance of proper stamping of documents but acknowledges that insufficient stamping is not a fatal defect. Additionally, it clarifies that proceedings under the SARFAESI Act cannot hinder the initiation of insolvency proceedings under the IBC.