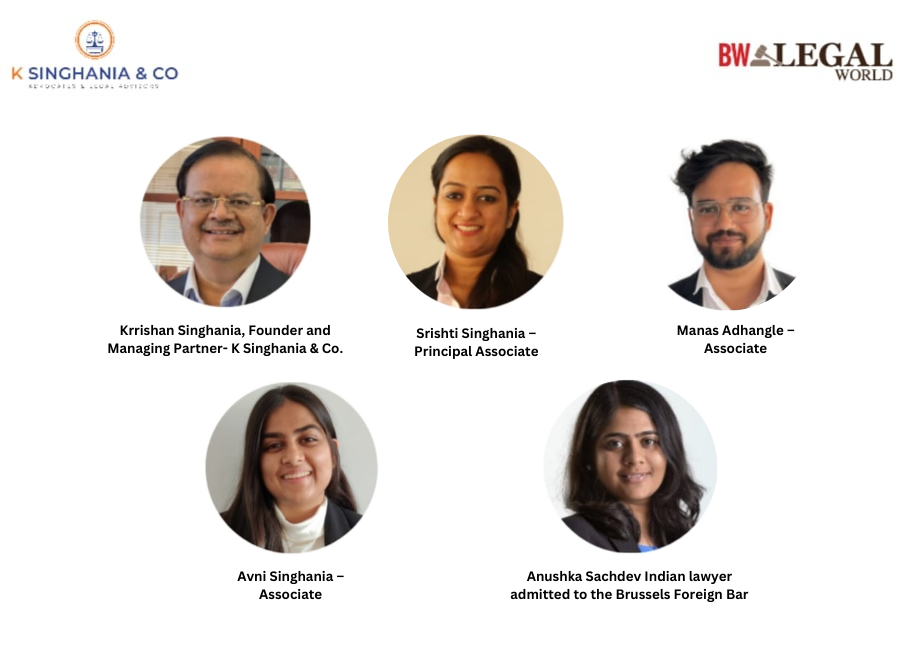

By Srishti Singhania | March 31, 2020

Published in

COVID-19: Whether Companies can see it as a silver lining?

Caution is appropriate. Preparedness is appropriate. Panic is not.

US Surgeon General Dr. Jerome Adams

The coronavirus (also known as COVID – 19) has affected more than 196 countries and territories and has shook the global economy severely. The UN Conference on Trade and Development (UNCTAD) has estimated the economic impact of COVID-19 at a minimum of $1 trillion in 2020. The Indian economy too has been afflicted by this global meltdown. On 24 March 2020, the Indian Government imposed a country-wide lock down for 21 days for fighting out this global pandemic.It has been predicted that this lock down may cause the country to go into recession, companies to become bankrupt and India’s GDP growth to go below the estimated 5 per cent for the Financial Year 2020.

The severity of the outbreak, has posed companies with unprecedented challenges. These challenges can be navigated only through comprehensive planning, a robust action plan for the present and preparedness for the future. The Indian Government too is leaving no stone unturned to provide relief to businesses in these difficult times. Through this article, we aim to educate businesses about the relief measures adopted by the Indian Government; and discuss measure that can be adopted by companies to mitigate their losses and perhaps see these times as an opportunity to grow their capabilities.

Relief Measures

On 24 March 2020, the Finance Minister of India announced several relief measures in relation to statutory and regulatory compliance matters. In relation to Income Tax, the deadline to file Income Tax returns has been extended to 30 June 2020. Certain compliance by the tax payers, and the Income Tax proceedings that had to be completed between 20 March 2020 to 29 June 2020, have been extended to 30 June 2020. Further, the interest rate has been reduced from 12%-18% per annum to 9% per annum for delayed payments of certain taxes made between 20 March 2020 and 30 June 2020.

With regard to company compliances, the payment of any additional charge for the late filing of any document or form with the Ministry of Corporate Affairs (MCA), due to be filed before or during the moratorium period from 1 April 2020 to 30 September 2020, has been waived off. This not only reduces the compliance and financial burden of companies but also enables long-standing non-compliant companies to make a ‘fresh start’.

Companies have also been allowed to hold the mandatory Board meetings within a period of 180 days instead of 120 days, as prescribed under the Companies Act 2013, till 30 September 2020. In order to facilitate social distancing, the MCA has also permitted Board meetings to be held through video conferencing or other audio-visual means till 30 June 2020, including for matters such as approval of financial statements and the report of the board of directors. 5 To ease doing business, newly incorporated companies have also been granted a time period of 12 months (instead of 6 months) from the date of incorporation to file a declaration for Commencement of Business.

Certain violations under the provisions of the Companies Act 2013 have also been waived. For example, in case the Independent Directors have not been able to hold at least one meeting without the attendance of Non-independent directors and members of management for the year 2019-20, the same will not be viewed as a violation of Schedule 4 of the Companies Act 2013. Further if at least one director of any company is not able to reside in India for a minimum period of 182 days, it will not be treated as a violation of Section 149 of the Companies Act 2013.

The Companies (Auditor’s Report) Order, 2020, that makes it mandatory for companies to disclose all whistle blower complaints to the auditor, has been now made applicable from the financial year 2020-2021 instead of from 2019-2020 as notified earlier. Further, the timeline for creating a Deposit reserve of 20% of deposits maturing during the financial year 2020-21 has been extended till 30 June 2020. The requirement to invest 15% of debentures maturing during a particular year in specified instruments before 30 April 2020 has also been extended till 30 June 2020. These relaxations will significantly reduce the compliance burden for Companies.

The MCA has also clarified that any expenditure towards COVID-19 for promoting healthcare and disaster management shall be considered as eligible corporate social responsibility (CSR) expenditure. 6 This is a welcome move in such difficult times.

Safeguarding from bankruptcy or insolvency

In order to prevent companies (especially Micro, Small and Medium Enterprises) from going into bankruptcy, the threshold of default under Section 4 of the Insolvency and Bankruptcy Code 2016 (IBC) has been increased to Rs. 1 crore from the existing threshold of Rs 1 lakh. The Central Government has not mentioned that this threshold is only applicable to defaults occurring during the lockdown; thus, the threshold will be applicable from the date of notification irrespective of the date of default.

The Central Government has also mentioned that it may consider suspending the right of a financial creditor, operational creditor and company to file an application to initiate insolvency proceedings under Sections 7, 9 and 10 of the IBC, respectively, for a period of 6 months, in case this severe situation continues beyond 30 April 2020. In case these provisions are suspended, it will give time to the companies to restructure their debt.

In order to give further relief to companies, the Insolvency and Bankruptcy Board of India has introduced Regulation 40C by way of an amendment to the Insolvency and Bankruptcy Board of India (Insolvency Resolution Process for Corporate Persons) Regulations, 2016. 8 Regulation 40C provides that the period of lock down imposed by the Central Government in the wake of COVID-19 outbreak shall not be counted for the purposes of the time-line for any activity that could not be completed due to such lock down, in relation to a corporate insolvency resolution process. This amendment shall come into force on 29 March 2020. This amendment is a much-needed step to prevent companies from going into liquidation.

Reviewing “Force Majeure” clause and re-negotiating agreements

‘Force Majeure’ refers to “events outside the control of the parties and which prevent one or both of the parties from performing their contractual obligations”. The outbreak of Covid-19 has made it difficult for companies to comply with their contractual obligations and they want to know whether they can take the defense of ‘Force Majeure’ to relieve themselves from the liability of non-performance of contractual obligations. The answer to this question would be a factual determination based on the specific terms of the ‘Force Majeure’ clause in the contract. Each contract varies widely and thus needs to be reviewed carefully.

In case the contract is silent with respect to such an event, the parties can take recourse under Section 56 of the Indian Contract Act, 1872. The said Section 56 states that the contract becomes void if it becomes impossible or unlawful for the parties to fulfill their obligations by reason of some event beyond their control. However, this doctrine cannot be invoked merely on the ground that the performance of the contract becomes expensive or commercially onerous or is delayed on account of the unforeseen event.

Moreover, the party invoking ‘Force Majeure’ needs to prove that there is no alternative means or method for performing its contractual obligation and that it has taken all reasonable efforts to avoid or mitigate the ‘Force Majeure’ event and its effects. Thus, the issue whether COVID-19 would be considered a ‘Force Majeure’ will depend upon the facts of each case.

The Ministry of Finance, the Department of Expenditure, Procurement Policy Division, has issued an Office Memorandum on 19 February 2020 11 clarifying that the disruption of the supply chain due to the Covid – 19 outbreak will be covered in the ‘Force Majeure’on the basis that it is a natural calamity. This clarification has been made with respect to the Manual for Procurement of Goods, 2017, which applies to procurement by Government organisations. In relation to non-government contracts, one will still have to analyse the terms of the contract. A similar clarification has been made by the Ministry of New Renewable Energy in its Office Memorandum dated 20 March 2020, which states that ‘Force Majeure’ clause can be invoked in case there is any delay in the scheduled commissioning date of Renewable Energy projects due to Covid-19.

With the nationwide lock-down for a period of 21 days, there are high chances of increase in tenancy disputes with tenants requesting landlords to exempt them from paying rent owing to the significant decline in the business. There has also been news of start-ups requesting co- working spaces to renegotiate their terms of membership. The legal recourse available to both parties is the ‘Force Majeure’ clause inserted in the agreement. Another solution could be to re-negotiate their contracts and ensure that the interest of both the parties is protected. In case one of the party decides to invoke the ‘Force Majeure’ clause, they should comply with the notice requirements as provided under the contract and also collect evidence to prove the disruption in performance of the contract.

The Way Forward

Apart from taking benefit of the reliefs granted by the Indian government, companies can take the following practical steps to mitigate the losses due to the present crisis:

- Reviewing Insurance Policies – Companies should review insurance policies to determine whether they may be covered for losses due to business interruptions attributable to Covid-19, and comply with all notice requirements under the policy.

- Leverage Technology – With the culture of work from home being implemented, companies are fast tracking their digital transformation. They are using tools like video conferencing to hold meetings and webinars; and are continuing to provide uninterrupted service to their clientele. Technology companies are coming up with products that can assist companies to work remotely. This also comes in as a benefit to employees who are now able to maintain a work-life balance. This pandemic is also making companies build their technology infrastructure and rethink their business model for the future. The lock down is also boosting the business of technology companies. Customers are relying more on online shopping which has lead to Amazon hiring 1,00,000 warehouse workers to meet the growing demand. Video calling and messaging at Facebook has exploded and online collaboration has increased by 40 percent in a week as reported by Microsoft . On a lighter note, Covid-19 is taking us closer to a digital India that our Prime Minister, Shri Narendra Modi has been envisioning since the beginning of his tenure in 2014.

- Draft commercial contracts for the future – This crisis has made companies revisit the ‘Force Majeure’ clause in their commercial agreements. It is time to re-negotiate these agreements to ensure that the interests of both parties can be protected and losses can be mitigated. It also important to keep such a pandemic in mind when negotiating future contracts and drafting company policies.

It is said that challenges are opportunities in disguise. These unprecedented challenges will definitely ensure that companies become more resilient, technologically advance and come up with innovative and out-of-box solutions to overcome these times.

Subscribe to our Newsletter

Sign up for daily, weekly, monthly newsletter to get the latest news updates delivered directly to your inbox.

Recent Posts

-

Protecting Brands In India And Europe: Comparison Of Trademarks Laws

February 21, 2024

Leave a Reply